By Steven T. Jones and Parker Yesko

Airbnb is an audacious corporation, particularly in San Francisco, the city where it’s headquartered and where its business model works best. This city is tech-savvy and popular with tourists, but hotels here are expensive, while rent-controlled apartments are still affordable, creating a strong incentive to rent those rooms at a profit through Airbnb.

The problem is that its business model is basically illegal. Its users violate five different sections of laws in San Francisco, from planning codes to tax laws to rent control. Disrupting complex regulatory systems developed over decades, Airbnb has managed to unite traditional adversaries against it: both the Hotel Council of San Francisco and the hotel workers of UNITE-HERE Local 2, both the landlords from the San Francisco Apartment Association and the renters from the San Francisco Tenants Union.

But Airbnb and its young founders just don’t seem to give a fuck about any of that. Sure, most of its hosts in San Francisco are violating their leases and land use laws, and a string of them have gotten evicted as a result. But Airbnb is rolling in cash, with Forbes now valuing the company in the billions, with a B, thanks to the double-digit percentage it takes from every transaction, low overheard costs, and venture capitalists who can’t seem to throw enough money at the company.

When the San Francisco Tax Collector’s Office last year held hearings on whether Airbnb and similar companies must collect the city’s transient occupancy tax (TOT), the surcharge of up to 16 percent that hotels charge to guests, the company rallied dozens of its local hosts to oppose the taxation and even enlisted the support of Mayor Ed Lee, who shares a financial benefactor with Airbnb: venture capitalist Ron Conway.

It wasn’t enough to overcome the clarity of city tax laws and the equity arguments made by the hotels, and the city ruled that Airbnb and/or its hosts are responsible for collecting the TOT. So what did the company do? Nothing. It just kept making money and stiffing the city, and when the Guardian wrote about how it appears to be shirking that annual tax bill of nearly $2 million (see “Airbnb isn’t sharing,” 3/19/13), the company and its consultants simply refused to answer our calls or questions — then and now, for months.

As this story was going to press, the company did finally send us a prepared statement that was more self-promotional than responsive to our questions, but it included the line, “Airbnb is committed to working with the City on policies that make San Francisco stronger, promote innovation, and ensure the sharing economy continues to grow.”

Really, you almost have to admire these guys’ chutzpah. Except for the fact that Airbnb and similar companies — VRBO, Roomorama, HomeAway, countless new upstarts, as well the DIY option of Craigslist — are exacerbating the city’s housing crisis by taking thousands of apartments off the rental market, driving up rents, and causing evictions in the process.

Board of Supervisors President David Chiu stepped in to mediate this mess early this year, trying to create legislation that would legalize and regulate the activities of Airbnb and other so-called “shareable housing” companies. But hopes of introducing something in the spring turned into a goal of midsummer, then by the August recess, and now sometime this fall, hopefully.

In the meantime, the money keeps rolling into Airbnb, complaints against it mount (here and in other big cities), its tax bill goes unpaid, and the landlords and tenants, the hoteliers and the workers, are all left to wonder why the city can’t or won’t enforce its own laws.

CHIU’S CHALLENGE

Chiu may have met his match with Airbnb. He has forged compromises on some of the toughest legislative challenges that City Hall has wrestled with this year — including condo conversions, CEQA reform, and the CPMC hospital deal — each time finding the acceptable middle ground between the progressive and moderate supervisors and constituencies.

His approach to this one sounds similarly centrist, with Chiu supporting the concept of shareable housing but understanding the myriad problems that Airbnb is presenting in complex cities. He neither sounds Lee’s unqualified boosterism of Airbnb nor does he fret about its impact on the housing market as much as its critics.

“I do not think shareable housing is either the cause or the solution to the housing crisis,” Chiu told us.

He’s striving for something between New York City’s total ban on tenants renting out their apartments while they’re away and the laissez faire approach of other big tourist cities. He sees some merit in Chicago’s requirement that Airbnb hosts register with the city to regulate it, but that’s not quite what he wants to do either.

“It’s a much less materialistic way to live and that’s a good thing,” Chiu said of the basic shareable economy concept of making more efficient use of existing resources, whether it be housing, cars, or consumer goods.

But he’s equally clear in identifying the problems and overhyped claims, acknowledging that “it takes away housing from permanent residents, driving up the cost of housing.”

While he says it’s good to spread visiting tourists and their money around the city — a regular claim of Airbnb and its advocates — that also creates problems when apartments become virtual hotel rooms, disturbing neighbors and upsetting the dynamics of landlord-tenant relations.

“Shareable housing is used and abused in ways that displace permanent San Francisco residents,” Chiu said. “Those are the excesses that need to be reined in, in a serious way.”

So he’s trying to create legislation that will set fair and clear standards, ensure compliance with city laws, improve the city’s enforcement of those laws, and generate “tax revenues to cover the city’s expenses in hosting hundreds of thousands, if not millions, of visitors every year.”

But Airbnb has only complicated Chiu’s goals and his reputation as the legislator who solves tough problems, largely because knowledgeable sources tell us the company has been unwilling to really compromise — perhaps emboldened by support from the Mayor’s Office and the city’s apparent impotence to enforce its own rulings — and is dragging out the negotiations.

Chiu wouldn’t comment on that, but he did acknowledge that these negotiations have been difficult. How can you allow renters to make a little extra money while recognizing the rights and concerns of their landlords and neighbors? How can you protect rent control and still allow tenants to profit from their units? Can you prevent landlords from using Airbnb or VRBO to bypass rent control? If you create a registry to ensure only permanent residents are playing host, what’s to stop landlords from using that list to evict those on it?

“We want to carve out a reasonable opportunity for people to do this,” Chiu said. “This is tough partly because of these complexities, and the laws are on the books for a reason….The more we pull these strings, the more this unravels.”

LANDLORDS AND TENANTS TOGETHER

San Francisco Tenants Union Executive Director Ted Gullicksen has been involved with the Chiu-Airbnb negotiations — from which he hopes to strengthen enforcement of rent control and apartment conversion laws while still allowing limited use of shareable housing sites by tenants — and he told us, “It turned out to be a very slow process.”

“Airbnb has just been balking and wanting more and more,” Gullicksen told us. “This process has been frustrating, but Chiu has hung in there.”

Gullicksen said the goal has been to limit short-term hosting to fewer than 90 days in a 12-month period, with only permanent city residents allowed to host, but Airbnb wants people to be able to rent out their apartments for eight months. And Gullicksen said he wants to see tenant laws and the rental stock protected from conversion to vacation rentals.

“We’re most concerned about the impact on the housing stock and evictions, because there’s so many of these…We have entire buildings that have been on the tourist market for years,” Gullicksen said. “It added a huge new way to remove units from the rental market.”

Gullicksen said that conversions of apartments became an even bigger problem than conversions to condos when the financial crisis hit in 2008, and that could become an even bigger problem now that the condo conversion lottery has been suspended for 10 years under legislation approved earlier this year (“Supervisors approve condo legislation,” Politics blog, 6/11/13).

In fact, he said that there has been a rash of unusual Ellis Act evictions in recent months, with buildings that have six or more units being cleared of tenants even though they are ineligible for condo conversions, raising suspicions that they’re being used for vacation rentals.

Hotel Council Executive Director Kevin Carroll told us Airbnb and similar companies should be paying the TOT, as the city ruled, and he doesn’t understand how they’ve gotten away with it for so long.

“A visitor to San Francisco, whether they are staying with Airbnb or a hotel, they’re using city services,” he told the Guardian, dismissing the arguments that shareable housing companies should be treated differently. “They do compete with hotels.”

Janan New, executive director of the San Francisco Apartment Association, expressed frustration that city officials have let this situation drag on as long as it has.

“I don’t know why [Tax Collector Jose] Cisneros isn’t collecting the tax. I don’t understand it,” New told us. “They certainly have the money.”

Cisneros told us that his office has the power to audit companies, “and we can bring taxpayers into courts of law,” but because of taxpayer privacy laws, he can’t discuss what’s happening with Airbnb.

“I cannot confirm or deny or discuss what is or isn’t being done,” Cisneros said, even refusing to offer an off-the-record assurance that something is being done to back up his ruling last year and address the perception that companies are free to flout his authority with impunity.

Attorney James Parrinello, representing SFAA and Coalition for Better Housing, sent a letter to top city officials on Jan. 14 “to discuss the fast-growing practice of illegal short-term/transient rentals for profit and request the City take immediate action to address the problem.”

New said they never got a response, although she tells us, “We did have a candid dialogue with [Chiu] six months ago.”

“All of these tenants in San Francisco are using their units as pieds-a-terre for out-of-town tourists and they’re doing it in ways that jeopardize their rent control status and the safety of their neighbors,” New said.

She told stories of visitors being loud, disrespectful, even committing an assault. She said one tenant placed a lockbox on his door to facilitate a rotating series of guests, while another rented out a second apartment in his building exclusively for Airbnb guests.

And she confirmed that her association has worked with landlords to search Airbnb and other sites to identify tenants who are illegally renting out their apartments and to serve them with three-day “notice to quit” warnings, otherwise they would be evicted.

“Under rent control, some tenants are making more money than they pay in rent,” New said, noting that landlords are essentially underwriting the rentals. “It’s stealing.”

Gullicksen expressed concerns that landlords are doing that kind of research to try to evict tenants, but he said the Tenants Union is doing similar research to ferret out landlords who are using these services to illegally turn apartments where evictions have taken place into vacation rentals and de facto hotels, focused mostly on VRBO because “they have a greater landlord emphasis.”

“The homes that we’re talking about are owned by the person that’s renting them out. It’s not people that are basically subletting their homes,” VRBO spokesperson Victor Wang told us, refusing to comment on local apartment conversion laws or other issues specific to San Francisco.

Chiu told us he takes the rent control issues seriously: “Our rent control laws are in place for very important reasons and we need to make sure it stays affordable.”

DISAPPEARING APARTMENTS

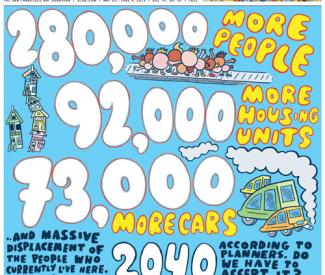

In a city experiencing what politicians and activists of all stripes have called a “housing crisis,” it might come as a surprise that US Census numbers indicate 8.3 percent of San Francisco’s rental stock was vacant in 2010 — about 31,000 units — up from 4.9 percent a decade earlier.

Scott James, homeowner and small-time landlord advocate, would have us believe that rent control is to blame, arguing in a recent New York Times op-ed (“King of My Castle? Yeah, Right,” 6/11/13) that “San Francisco’s anti-landlord housing laws and political climate make [renting] untenable.”

Faced with a bad tenant at his home in the Castro, James said he “joined the ranks of thousands of other small-time landlords here who will never rent again, adding to the city’s housing shortage.”

Yet the San Francisco Rent Ordinance confers broad authority to evict tenants for a plethora of “just causes,” including late payments, breach of lease (such as, ahem, illegal subletting), nuisance or damage to property, and owner move-in. Since the law dates back to 1979, it probably doesn’t explain the steep rise in vacancies. And with evictions now hitting an 11-year high, it’s hard to paint landlords as helpless victims.

San Francisco Rent Board Executive Director Delene Wolf told us the eviction rate has actually mimicked bullishness in the real estate market rather than beefier tenant regulations. She said it “really spiked around the dot-com years, for obvious reasons went way down during the recession, and it’s back up now because the market heated up.”

Some embittered landlords may indeed live atop empty units for decades but, given a median rental price of $2,764 per month for a one-bedroom unit, there’s an enormous opportunity cost to being disgruntled.

But perhaps that’s what “shareable housing” is really about: getting around the rules to make some money. Short-term rentals have become so lucrative that it’s financially possible, and easier than ever, for a homeowner to exit the long-term rental market for good.

Airbnb is so unregulated that even a homeowner who has used the Ellis Act to supposedly get out of the rental business could easily and anonymously monetize an officially vacant space for higher profit margins and with less oversight as a “vacation” rental.

Annette Fajardo has made clients out of people like James. She started her business, SF Holiday Rentals, just after the first dot-com boom, when she began managing short-term rentals in the homes of her friends. When she had nine properties in her roster, the business became a full-time job.

Over the last decade, demand for her management services has increased so much that she says she’s now “very picky about who she works with.”

Fajardo currently manages more than 40 furnished units that guests can book on her own website, as well as Airbnb, Roomorama, VRBO, HomeAway, Trip Advisor, and Craigslist. Her clients are all owners offering full homes or apartments and all the units she manages have been permanently withdrawn from the long-term rental market.

Quite often, her guests stay for a month or longer. Some are international tourists, but the majority are new corporate transplants to San Francisco. The demand for units like hers keeps growing: She gets 100 inquiries on her properties each day, about half from Airbnb.

“There’s always been corporate furnished rentals,” Fajardo told us in the dining room of a Castro flat that she lists for $350 per night on Airbnb. “That market has always been there. It’s just that there’s so much more business now. We got Google, Apple — you’ve got the busses running here all the time. I get Google people all the time and they spend big bucks.”

And she’s been through it all — battles with the tax collector in three municipalities, catastrophic fires in two properties, fraudulent guests, drunk guests, pornographers, and, worst of all, meddlesome neighbors.

“Your neighbors are a problem,” Fajardo emphasized. “In the Castro, you have to do a 30 night minimum cause the neighbors fink on you.” And when they do, the Planning Department can step in. They “send a letter stating the residential code and to cease and desist. If you don’t stop less than 30 night rentals, then they can fine you.”

COMPLEX LAWS, SIMPLE SITE

City tax and zoning laws ban apartment rentals of less than 30 days, labeling it “illegal hotelling.” Dwellings in residential areas repurposed as tourist housing have, in the eyes of the Planning Department, essentially been commercialized without proper permitting or payment of the TOT.

Rentals for more than 30 days aren’t regulated as commercial properties, but the tenants in those homes have rights under the 1979 rent ordinance, which protects any tenant who, according to Rent Board spokesperson Robert Collins, “pays rent and inhabits a unit for two days. You don’t have to sign a lease to be a tenant — you just have to pay rent and occupy the unit.”

This presents a number of challenges to both tenant- and owner-hosts. Tenants who gouge tourists on nightly rates are often in violation of a rent ordinance ban on “charging upon additional occupancy more than the rent that the tenant pays to the owner,” explained Collins.

Tenants who rent out their apartment for a few days can even lose their rights to reclaim their homes. Collins cited multiple cases where subletters refused to leave and returning tenants had little legal recourse because “they would not have a just cause to evict the subtenant because, if they’ve rented the entire unit, they aren’t themselves a resident in the unit.”

Owners who offer their units on Airbnb assume the same risk of unwanted, long-term guests. But they hedge against it by charging exorbitant nightly, weekly, and even monthly rates. On the off chance that a guest does demand a lasting lease, Fajardo reasons, “if I’m getting $5,500 a month for a two-bedroom, you can stay for the next 10 years.”

Fajardo knows where laws limit her opportunity for gain and to remain within their bounds. But most hosts, the ones Airbnb advertises as offering “unused space to pay your bills or fund your next vacation,” aren’t running a sophisticated business. And Airbnb offers them little help or support.

Airbnb just lists the rentals then mediates the payments. And the company collects revenue at both ends of transactions, charging guests a 6-12 percent service fee upon booking then taking another 3 percent before remitting payment to hosts.

Anyone can create a guest or host profile and Airbnb conducts no user verification, although both can leave online reviews. “We do not attempt to confirm, and do not confirm, any Member’s purported identity,” Airbnb states in its terms of service. “You are responsible for determining the identity and suitability of others.”

The company advertises a $1 million “Host Guarantee” backed by Lloyd’s of London, but warns that it “should not be considered as a replacement or stand-in for homeowners or renters insurance. The Host Guarantee does not cover: cash and securities, collectibles, rare artwork, jewelry, pets, personal liability.”

The site also does not vet the content of property listings for legality. Hosts can set their rates and even add on a cleaning fee or refundable security deposit, but it offers no functionality for hosts to itemize and collect the TOT, now more than a year after San Francisco required that it be collected.

Tax issues are only vaguely addressed in an FAQ section for hosts, noting that “some hosts are required by their locality to charge a tax.” Hosts ambitious enough to attempt compliance must essentially become amateur tax specialists. Few, however, have the experience to decipher the code correctly and even fewer are likely to seek it out in the first place.

A search for the word “tax” across the site’s roughly 4,750 San Francisco listings yielded a mere 174 hits and myriad approaches to the issue. Several hosts mentioned collecting the TOT in cash on arrival or required credit card information in advance — a clear incursion into the secure nature of the transaction. A host named Jesse with 85 listings told the Guardian that he just rolls the TOT up into his daily rates, despite the city’s requirement that it be listed separately.

Fajardo isn’t alone in creating a full-time business of short-term apartment rentals. Casa Buena Vista Rental lists 76 properties on its website, many of which overlap with Jesse’s 85 Airbnb listings. A host named Bernat has 48 listings that also appear on Come2SF.com. Gaylord Suites, a Tenderloin apartment complex, markets at least seven different apartments in the same building on the site.

Fajardo said she’s pushed Airbnb for a dedicated TOT field “until [she’s] been blue in the face,” but she feels strongly that the company should not be held responsible for the collection of tax itself. “It’s not their burden,” Fajardo argues in defense of Airbnb. “They’re a booking agent. They funnel the money and they expect you to do the taxes.”

OTHERS CAN DO IT

The New York- and Singapore-based Roomorama was founded in 2009 and has a nearly identical payment model to Airbnb’s. But it has a formal host verification process and a higher price point that CEO Jia En Teo told us helps to filter out bad guests.

“Our host verification is very tight,” explained Teo. “When a host is listed on our site, they don’t go live immediately. They go through a quality control and validation process. We have a team that will call the host and ask for utility bills and ID. We do due diligence.”

Teo said a TOT field has been included in Roomorama’s price template from the beginning since the vast majority of the site’s listings are “professionally managed properties, people that are actually licensed to run short-term rentals. They’d already been paying and collecting these taxes….One of the first things that was requested was a way to collect.”

Teo also said that if Roomorama, as an operator, was deemed responsible for collection and remittance of taxes, it wouldn’t be “difficult from a logistical standpoint. It would add more work to our load but, to be honest, most of it is automated anyway. Once we put in the mandatory tax field, it would simply be paid the same way a consumer pays when they eat at a restaurant.”

She’s unsure why Airbnb has been so reluctant to address the tax issue head on, but “if I could venture a guess,” she said. “I’m guessing it’s because they work more with the occasional host, and that makes their value proposition a little bit less appealing.”

Other industry competitors include Craigslist and VRBO, both founded in 1996, and VRBO’s parent company, HomeAway. All three share a similar business model and one that’s considerably different from Airbnb’s — they are not financial gatekeepers in the transaction between guest and host. At their essence, these sites are little more than digital classified ads.

No competitor comes close to the market share that Airbnb has captured in San Francisco and globally. In New York, Roomorama has 2,688 listings compared with Airbnb’s 25,724, despite its questionable legality there. In San Francisco, Roomorama hosts 303 properties and VRBO features 1,123 — and Airbnb has about 4,750 throughout the city.

Airbnb’s statement to us touted that financial impact: “We are proud of the $56 million that Airbnb’s users generated for the San Francisco economy last year. The vast majority of Airbnb hosts share the home where they live, and more than half directly use their Airbnb income to pay their rent or mortgage.”

THE CITY’S SHARE

When the San Francisco Tax Collector’s Office discussed the matter last year and issued “Tax Collector Regulation 2012-1: Tax on Transient Occupancy — Multiple Party Transactions; Occupancy of Private Residences,” it made clear Airbnb should be collecting the tax as it processes the transactions.

“A website company, or any other person acting as merchant of record who receives rent in connection with an occupancy transaction, is an ‘operator’ who is responsible for collecting the TOT owed by the occupant and for remitting the TOT to the City. Any person receiving such rent shall provide a receipt to the occupant. Such receipt shall include a separate line item specifically identifying the TOT,” reads the regulation.

While it’s also true that the city tax codes make Airbnb and its hosts jointly liable for the tax debt — which the company’s apologists have used to accuse the Guardian of unfairly picking on the company in an avalanche of online comments —it would be a regulatory nightmare for the city to go after thousands of individual hosts, most of them small-time tenants who don’t even have business licenses.

Fajardo is diligent about compliance, but she can afford to be. She works with a team that includes assistants and an accountant and she does it full-time. She is not the casual homeowner supplementing her income (and it’s unlikely many of her clients are either) — she is an entrepreneur. And even she admits to having found the TOT difficult to interpret.

Fajardo contacted the Guardian in June in response to our coverage of Airbnb, citing the city’s complicated tax system and the difficulty that small users have in paying the TOT, which has varying fees tacked onto the base rate of 14 percent. (Although she also wrote, “We collect and pay sometimes as much as $10,000-20,000 per quarter.”)

“Don’t blame Airbnb, blame the SF Tax Collector for a shoddy website, incompetent workers, and their inability or lack of desire to chase individual lessors. It is not the responsibility of Airbnb to collect taxes; it is the responsibility of the lessor to collect the taxes, just like a hotel,” Fajardo wrote.

It’s certainly true that TOT rates aren’t simple — the 14 percent base rate gets another 1.5-2 percent tacked on it, depending on where the host is located, to fund the Tourism Improvement District proposed by hotels and approved by the city. (That fee just went up again July 1 to fund an expansion of the Moscone Convention Center.) The TOT also isn’t simple for Airbnb hosts to collect and pay.

We forwarded Fajardo’s criticisms and concerns to Greg Kato, the policy and legislative director for the Tax Collector’s Office. He acknowledged that the system is complicated — particularly for Airbnb hosts who aren’t legally allowed to operate as a hotel — but he said they try to simplify it as much as possible.

To pay taxes, a business first needs to register with the city by paying a $26 fee and filling out an application, which includes a line indicating whether transient occupancy is part of the business. “There are few, if any, barriers to initially register as a business,” Kato said.

The problems come when that business applies to the city for its “certificate of authority” to collect the taxes, and applicants are asked whether they have the relevant licenses and proper zoning to conduct that kind of business. And most Airbnb hosts don’t have that because they are actually violating a variety of city codes.

“In a residentially zoned area, this type of use is at least a conditional use [which requires a permit obtained after giving neighbors notice and going through a public hearing] if not a banned use,” Kato told us. “Those land use issues are what Sup. Chiu is trying to address with his legislation.”

Although Kato said such legislation is beyond the scope of his office, those issues can interfere with a host’s ability to receive a certificate of authority to collect the taxes.

“There are a lot of other parties interested in this issue that might have other issues that would break that authority,” Kato said, citing landlords, homeowners associations, and neighbors as parties that might object to someone essentially turning his or her apartment into a hotel room, which was banned decades ago by the Apartment Conversion Ordinance.

It’s pretty easy to see on the Airbnb website that it isn’t charging the TOT or making it easy for its hosts to do so (see “Airbnb isn’t sharing,” 3/19/13). Using Airbnb’s own stated figure that its San Francisco hosts collect about $12.7 million in rents each year, that would amount to nearly $2 million annually that the city should be collecting on these transactions.

When Airbnb’s 31-year-old founder and CEO Brian Chesky spoke at a hospitality conference organized by USF in April, he didn’t acknowledge any complexities or downsides to his business model, instead casting his company as saving the world.

“It’s like the United Nations at every kitchen table. It’s very powerful,” Chesky said of the social benefits of his company. “I think we’re in the midst of a revolution.” He wasn’t talking about revolution in the sense of challenging the authority or legitimacy of San Francisco, its laws, or its elected leaders, although that seems to be implicitly what he’s doing. And he certainly didn’t seem to be taking into account his evicted hosts, their upset neighbors and landlords, or the city’s disappearing apartments and rising rents when he said, “For us to win, no one has to lose.”