rebeccab@sfbg.com

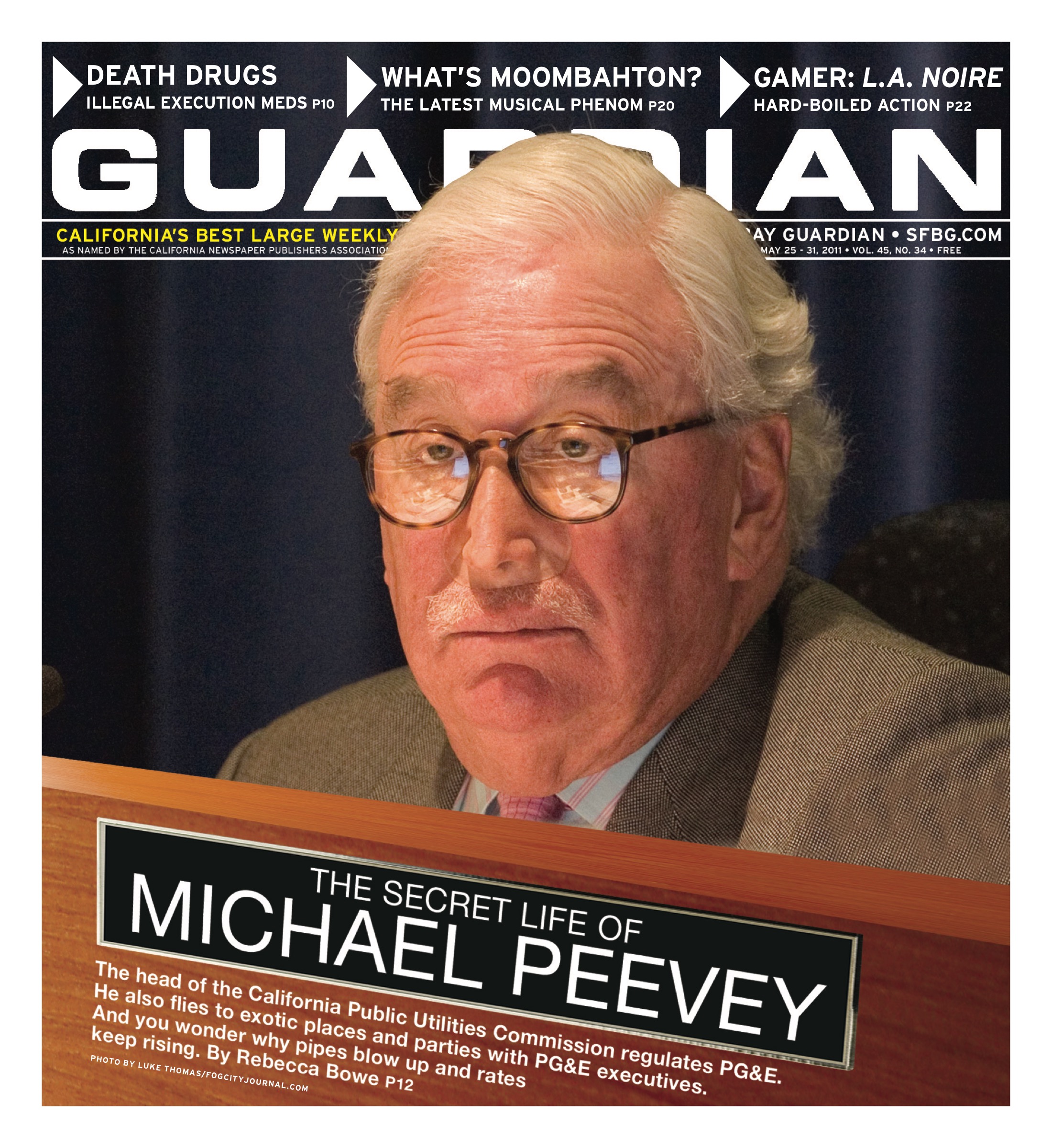

Inside a legislative hearing room at the state capitol, things were beginning to get uncomfortable. Roughly five weeks had passed since a Pacific Gas & Electric Co. pipeline explosion killed eight and leveled an entire San Bruno neighborhood, and this California Senate committee hearing was an early attempt to get answers.

San Bruno residents who lost loved ones in the deadly explosion huddled in the front row, their eyes fixed on company representatives and agency bureaucrats as they spoke. At the back of the room, a band of immaculately dressed PG&E executives and utility lawyers sat clustered together.

Richard Clark, director of the consumer protection and safety division of the California Public Utilities Commission (CPUC), fielded questions from visibly frustrated state legislators. Sen. Dean Florez (D-Shafter) wanted know why the CPUC hadn’t done anything when PG&E ignored an impaired section of the ruptured pipeline even after it was granted $5 million to fix it.

“Did the PUC do any accounting when you gave them $5 million?” Florez demanded. “Do we just give them money and cross our fingers and hope they fix it? Is that what we do? Until some terrible tragedy occurs?”

Sen. Mark Leno (D-San Francisco) said the CPUC needed to step it up and start practicing serious hands-on oversight. He recalled a tragedy that occurred in 2008 when a gas leak in Rancho Cordova triggered a pipeline explosion, killing one person and injuring several others. Although an investigation determined that PG&E was at fault, the CPUC hadn’t yet gotten around to fining the company.

“We’ve got a pattern here,” Leno said. “And we’re not doing anything differently.”

Less than three weeks after CPUC staff members were grilled in Sacramento, Michael Peevey — president of the CPUC and the top energy official in the state — boarded an airplane for Madrid. He was embarking on a 12-day travel-study excursion, with stops in Sevilla and Barcelona, sponsored by the California Foundation on the Environment and the Economy (CFEE).

Peevey’s wife, California Sen. Carol Liu (D-Glendale), was along for the trip. So were two other state senators, several members of the state Assembly, CPUC commissioner Nancy Ryan, and a host of representatives from the energy industry. The group included executives from Chevron, Mirant (now GenOn, the owner of the Potrero power plant), Covanta Energy Corporation, Shell Energy North America, and engineering giant AECOM. High-ranking executives of the state’s investor-owned utilities also participated, including Fong Wan, the senior vice president of energy procurement for PG&E.

Although strict rules normally govern commissioners’ interactions with parties that have a financial stake in the outcomes of commission rulings, there wasn’t anything especially unusual about Peevey traveling internationally with a group that included representatives from the same companies his regulatory commission oversees. CFEE trips happen every year. The nonprofit has footed the bill to fly groups of regulators, legislators, and utility executives to prime vacation destinations like Italy, Brazil, and South Africa in recent years, excursions organizers say are critical for educating top-level stakeholders about worldwide best practices for sustainable systems. However, groups such as The Utility Reform Network (TURN) have decried CFEE trips as “lobbying junkets.”

As PG&E and the CPUC both work to win back the public’s confidence after their latest deadly failure, it’s worth analyzing whether their relationship — shaped by vacations together at exotic locales — has grown too cozy.

THE BUDDY SYSTEM

CFEE isn’t the only nonprofit that regularly flies Peevey overseas for green travel tours with high-ranking utility executives, and the 12 days he spent in Spain wasn’t the only time he spent away from official duties and in the company of the corporations his commission regulates.

These controversial getaways are just a small part of Peevey’s involvement with private-sector interests. He also chairs the board of a nonprofit investment fund created as part of a $30 million settlement agreement with PG&E. Called the California Clean Energy Fund, it funnels money into private venture-capital funds that invest in green start-ups, plus a few companies in the fossil-fuel sector.

While legislators have voiced frustration that lax CPUC oversight of PG&E on pipeline-safety issues opened the door to disaster in San Bruno, inside observers are critical of the outright favors Peevey has granted utilities, such as guaranteeing an unprecedented, higher-than-ever profit margin for PG&E as part of the company’s 2004 bankruptcy settlement.

The CPUC is set up to perform as a watchdog agency, yet social and professional ties running deep within California’s insular energy community mean regulators sometimes run in the same circles as the executives who answer to them, making for cozier relationships than the general public might anticipate. It’s an old-fashioned insider game that one longtime observer wryly characterizes as “the buddy system.” But the buddy system can bring consequences.

As the public face of the CPUC, Peevey repeatedly has been thrust into the spotlight. He has absorbed advocates’ concerns about pipeline safety, rising electricity rates, SmartMeters, missed targets for energy efficiency, and municipalities’ David-vs.-Goliath battles with PG&E to implement community choice aggregation (CCA), to name a few. He’s a magnet for public scrutiny while occupying the center seat at commission meetings, but Peevey’s behind-the-scenes engagements with private-sector organizations bent on shaping statewide energy policy demonstrate how power is wielded in California’s energy world, a system in which regulators seem to be partnering with utilities rather than policing them.

Based at Pier 35 in San Francisco, CFEE’s board of directors is composed of a small group of officers, plus a long list of members who hail from some of the most prominent businesses nationwide. Shell, Chevron, J.P. Morgan, Goldman Sachs, AT&T, and PG&E all hold positions on CFEE’s membership board, and each entity chips in to fund the foundation’s activities and travel excursions.

The group also includes representatives from labor organizations like the International Brotherhood of Electrical Workers and mainstream environmental groups such as the Natural Resources Defense Council. Among the emeritus members of CFEE’s governing board are some high-ranking figures, such as CIA director-turned-Pentagon boss Leon Panetta. CFEE received $45,000 in donations from PG&E in 2009 (the most recent year available) and was granted similar amounts in prior years.

CFEE spokesperson P.J. Johnston, the son of former state senator and CFEE officer Patrick Johnston and the press secretary under former Mayor Willie Brown, described the trips as valuable opportunities for top-level stakeholders to gain insight on best practices and engage in noncombative dialogue on key issues.

“The idea for us was that it made sense to have someplace where it was nonconfrontational to engage in policy, work-type discussions,” Johnston explained. He added that the trips are “all about policy, on the 30,000-foot level,” and emphasized that discussions aren’t about specific decisions pending before the CPUC.

Loretta Lynch, a former president of the CPUC who brought a reformist spirit to the agency and was never shy about rebuking utilities, is skeptical of CFEE’s stated program goals. When she was first appointed to the commission, Lynch said, CFEE contacted her to ask where she wanted to travel. If the trips are arranged to fly regulators to destinations they’ve been itching to visit, she reasoned, must-see green innovations probably aren’t dictating the itineraries. “To me,” Lynch said, “they don’t have anything to study in mind.”

“PARTYING WITH THE JUDGE”

The CFEE trip to Spain included a briefing on developing wind energy from AES, a company working on wind and solar development in California that also operates polluting, gas-fired power plants in Huntington Beach, Long Beach, and Redondo Beach. There was a round table on solar energy featuring a presentation from the Independent Energy Producers Association, a trade group that regularly files petitions and comments on CPUC proceedings. The trip included a tour of a desalination plant, a talk from the president of the Madrid Chamber of Commerce, and discussions about California’s energy market. Scheduled activities ended by midafternoon on some days, and the itinerary left a Friday afternoon, Saturday, and Sunday in Sevilla wide open.

Asked to comment on concerns about inappropriate lobbying, Johnston said: “We’re not guarding against anyone’s potential behavior any more than we would be on the streets of Sacramento. We’re not setting ourselves up as the guardians. We’re not facilitating that, per se, either.” He added, “I realize there are critics of any kind of travel and any kind of commingling. But it is wise for us not to close our eyes to the rest of the world, and there’s not a great appetite for spending taxpayer money on these trips.”

Yet Lynch countered that there is an important distinction between the roles of Sacramento legislators and that of utility commissioners. “Regulators are not legislators,” Lynch said. “They’re more like judges. Their decisions have the power of a judge’s decision.” By inviting commissioners along on these lavish getaways, she said, “it’s as if you’re partying with the judge.”

Mindy Spatt, a spokesperson for TURN, echoed Lynch’s concerns. “These ostensibly educational trips are essentially lobbying junkets, where utilities … wine and dine legislators,” Spatt said. TURN raised the issue several years ago, she said, when Peevey joined a CFEE trip attended by a representative of Southern California Edison “just coincidentally at the exact same time that he was penning an alternate decision in Edison’s rate case.” She added: “In TURN’s perspective, the commissioners need to be more in touch with what actual utility customers are experiencing, rather than in touch with the top restaurants in Brazil.”

While Peevey is only one of a host of officials who attend CFEE trips, he has more than just a casual tie to the nonprofit. From 1973 to 1983, he served as president of the California Coalition for Environment and Economic Balance (CCEEB), an organization CFEE grew out of and whose membership shares some overlap with CFEE.

Based in San Francisco, CCEEB was founded by Edmund G. “Pat” Brown (Gov. Jerry Brown’s father) in 1973. CCEEB backed a late-1970s proposal to construct a series of nuclear power plants along the California coastline. More recently, the group honored BP with a 2009 award for environmental education — shortly before the company and lax federal regulators were responsible for the worst oil spill in U.S. history.

A YEAR IN THE LIFE

Spain wasn’t the only country Peevey jetted off to with complimentary airfare in 2010. According to a Form 700 filing with the Fair Political Practices Commission, he also traveled to Germany from Aug. 1–5 for a sustainable energy study tour organized by the Energy Coalition. Joining that trip were representatives from investor-owned utilities PG&E, Southern California Edison, and Sempra, plus various city officials and energy experts from the Swedish Energy Agency.

The group stayed at the Radisson Blu Berlin Hotel, which is famous for its AquaDom. “Standing at 25 meters high, it is the world’s largest cylindrical aquarium containing 1 million liters of saltwater,” according to the hotel website. All Radisson Blu Berlin guests have free access to “the hotel’s well-being area,” called Splash, which features a pool, sauna, steam bath, and fitness room.

Based in Irvine, the Energy Coalition’s Board of Directors is chaired by Warren Mitchell, a retired chair of the Southern California Gas Co. and San Diego Gas & Electric Co.. Another director is a utility lawyer who also sits on the board of directors of the Northeast Gas Association, a consortium of natural gas companies in the northeastern U.S.

Founded in the late 1970s by John Phillips to get large businesses to reduce energy consumption in partnership with utilities, the Energy Coalition has arranged excursions for years to bring energy regulators, city officials, and utility executives to Sweden (where Phillips’ wife was born) to exchange ideas on energy issues. The nonprofit organizes an annual summit called the Aspen Accord, “an energy policy forum where cities, utilities, regulators, and end-users collaborate to identify problems and propose solutions to our most pressing energy issues,” according to a 2009 tax filing. While it used to be held in Aspen, Colo., the most recent Aspen Accord was held at San Francisco’s Westin St. Francis. Peevey gave introductory remarks, and the conference featured talks from PG&E, among others.

Craig Perkins, executive director, told the Guardian that the Aspen Accord and study trips are designed to create a venue for major stakeholders to arrive at outside-the-box solutions. “What we try to do is get everybody out of their comfort zone, if you will — that’s the best way to support more creative thinking,” he said. Official regulatory proceedings are “so rigidly legalistic and bureaucratic that it almost prevents any creative thought from happening,” he added. “We’re not in San Francisco, we’re not in Sacramento, we’re not in corporate offices — let’s just talk about these really big issues, and really big challenges.”

The Germany tour included meetings with the Berlin Energy Agency, talks about climate policy, and a tour of an eco-community in Freiburg. Perkins said utility companies must to pay their own way on the trips, but costs are covered for governmental officials.

An Energy Coalition tax filing reveals that board members receive a monthly retainer of $1,000, quarterly meeting fees of $1,000, plus $500 for each board committee meeting. Teleconferences also result in $500 meeting fees.

Several years ago, the Energy Coalition partnered with PG&E to create the Business Energy Coalition, which paid businesses including Bank of America and the Westin St. Francis $50 per KW of energy savings for banding together to reduce energy during peak load hours. According to a tax filing, total annual Energy Coalition revenue dropped from $10.7 million in 2008 to $3.75 million in 2009 “due to large revenue receipts for participant incentives” for the Business Energy Coalition program, as “revenues were used for direct pass-through payments to program participants and contractors.” In 2006, according to a CPUC filing, PG&E paid the Energy Coalition $227,373 for unspecified consulting services.

In addition to the $8,880 trip to Spain (comped), and the $6,583 trip to Germany last year (comped), Peevey’s 2010 disclosure form shows that he also went to Australia May 14-19 to participate in a conference hosted by the Sydney-based Total Environment Center called “Smart Metering to Empower the Smart Grid” ($12,577, comped). And while it doesn’t show up on his FPPC filing, an agenda for CFEE’s Energy Roundtable Summit from Dec. 9-10 at the Carneros Inn in Napa lists Peevey as a participant. A glance through past filings suggests that 2010 was no anomaly; it’s a typical year in the life of a jet-setting utilities regulator.

GREEN CAPITALISM

Peevey once served as president of the Southern California Edison, an investor-owned utility, and was president of NewEnergy, Inc., an electricity company that later was sold to Williams Energy. Yet his professional image is that of a forward-thinker on climate change. According to a bio on the CPUC website, he’s received awards for achievements on green and sustainable energy from various organizations throughout California.

In 2005, speaking in Berkeley at an annual conference for the California Climate Action Registry, Peevey touted a list of his accomplishments on sustainable energy. “My final example of PUC actions on climate change is related to PG&E‘s bankruptcy,“ he said. “When they emerged from bankruptcy last year, one of many conditions of our support for their reorganization plan was that they create a $30 million Clean Energy Fund, devoted to investing in California businesses developing and producing clean technologies.“

What Peevey didn‘t mention is that he chairs the board of directors of that fund. As a “nonprofit venture capital fund,“ the obscure, San Francisco-based CalCEF sounds like an oxymoron. Based on the terms of the PG&E bankruptcy settlement, it‘s governed by a nine-member board consisting of three CPUC appointees, three PG&E appointees, and the rest selected jointly by the CPUC and PG&E appointees. Other board members include past PG&E executives, a former member of the California Energy Commission, and a former chair of the board of governors of the California Independent System Operator (Cal-ISO), the body that ensures statewide grid reliability and blocked the closure of the Mirant Potrero Power Plant for years.

The nonprofit’s stated mission is to catalyze clean energy investment to aid in the state’s transition away from fossil fuels. CalCEF president Dan Adler described it as a sort of seasoned guide for fledgling green companies that might otherwise fail to navigate the murky, complicated clean-energy sector. CalCEF is in a position to usher start-ups toward success with a combination of funding, networking, and insider wisdom on state energy policy.

Among the challenges that the clean-energy sector faces, Adler said, are the utilities themselves. “They are effectively monopoly, or oligopoly, controllers of the energy industry,” he said. “And they don’t like outside innovation coming and disrupting their work process or their relationship with their customers.”

CalCEF aims to guide the finance community “to be partners with what public policy is doing around clean tech and clean energy,” Adler went on. “There’s a tremendous amount of money to be made, but there’s also a lot of opportunity for money to be wasted. If you don’t have a private-sector investment community that understands these rules and can put their money alongside these rules in a collaborative framework, we’re very unlikely to achieve the really aggressive energy targets that California has set.”

Yet as one skeptical energy insider noted, “there are 15 to 20 other funds, with 10 times as much money, an hour south in the same field,” referring to the burgeoning clean-tech hub in Silicon Valley. It’s questionable whether the CPUC is actually fulfilling some dire need with CalCEF, this person said.

Lynch, not surprisingly, takes a dim view of CalCEF. The former CPUC president questions what business the CPUC has creating a private foundation to guide venture capital investment. “It is a fundamental distortion of the PUC’s authority,” she charged, “all in service of Peevey’s ambitions.”

Peevey’s economic disclosure showed that he holds more than $1 million in a private family trust, without disclosing whether private investments contributed to that fund.

Adler stressed that there is arms-length relationship between CalCEF board members and the companies that benefit from the fund’s investments. “Because we are a nonprofit, and because we have on our board members of the regulatory community, we recognized quickly that we can’t be making direct investments into companies,” said Adler, a former CPUC staff member who was highly regarded even by the critics of CalCEF. “So … we’ve picked the venture-capital funds that we wanted to partner with.”

CalCEF funnels its capital into three different for-profit investment firms, which in turn select the companies that will be included in CalCEF’s investment portfolio. Several directors of the partnering investment firms also sit on the boards of directors of the companies they invest in. The startups run the gamut, from carbon-offset outfits, to energy-efficient lighting manufacturers to solar and wind companies, to biofuels startups to various kinds of technology firms related to the smart grid.

But CalCEF has also poured money into companies that bolster the fossil-fuel industry. One of its first investments was CoalTek, a company developing technology for so-called “clean coal.” Asked to explain why, Adler told the Guardian, “We don’t have veto power on every deal that goes down.”

Adler said he personally believes that “there’s no such thing as clean coal,” but tempered this by adding, “there are some very smart people in our community who will tell you that there’s no future … without coal.”

Another CalCEF investment, DynaPump, is developing technology to make it more energy efficient to pump oil and gas. Asked about this decision, Adler responded: “I will say that when we were approached with this investment by the venture partner that ultimately undertook it, we had our misgivings. If you can save energy in the production of oil and gas, then you’re definitely making a contribution to overall energy efficiency.”

TAX-EXEMPT TESLA

There appear to be some closer-than-arms-length links between CalCEF board members and the investment fund’s beneficiaries. A bio for CalCEF director Nancy Pfund, for example, notes that in her capacity as manager of an outside investment fund, she had “worked closely” with Tesla Motors, a CalCEF investment. Tesla provided CalCEF’s first investment return earlier this year after Tesla went public. A principal of one of the investment firms that works with CalCEF, Stephen Jurvetson of Draper Fisher Jurvetson, holds Tesla shares in a personal trust, according to a filing with the U.S. Securities and Exchange Commission.

Tesla manufactures sleek, electric, zero-emission sports cars with prices in the six-figures, and it’s gearing up to roll out a model that will cost somewhere closer to $50,000. The company’s success was helped by a sales-and-use-tax exclusion granted by the state of California last year. Peevey had a hand in that, too. Few Californians may have heard of the California Alternative Energy and Advanced Transportation Financing Authority (CAEATFA), a state body within the Office of the Treasurer, which has the power to authorize sales-tax exclusions for companies that are developing alternative energy technologies. Peevey has a seat on it.

In October 2009, according to a CAEATFA document, Tesla was granted a sales tax exclusion from that financing authority. The sports car manufacturer had received a tax break of $3.3 million as of December 2010, and stands to gain a tax break as large as $29.1 million, depending on its property purchases. As a CAEATFA member, Peevey approved the deal by proxy.

A central question is whether the CalCEF dollars that benefited Tesla and other CalCEF portfolio investments were originally derived from PG&E shareholder profits or ratepayer funds. Adler was careful to note that the initial $30 million came from company shareholders, not PG&E customers. But Lynch pointed out that every dime in PG&E coffers originates with the millions of customers who pay utility bills.

Lynch noted another provision of the bankruptcy settlement agreement, which guarantees PG&E a minimum annual profit of 11.2 percent, catapulting it forever into a higher rate of return than the 8 percent to 11 percent profit traditionally granted by the CPUC in prior decades. “They’re manipulating how big this bucket is to siphon off funds into programs like CalCEF,” Lynch said. “It’s all to give Peevey and his friends access — and to greenwash what was a very stinky deal for the ratepayer.”

ELUSIVE CLEAN ENERGY FUTURE

In California, a national leader in addressing climate change, the stakes are high in the energy sector. The CPUC is tasked not only with shoring up transmission-pipeline safety to prevent another San Bruno disaster, but helping to chart a course away from reliance on fossil fuel-powered energy sources.

CFEE, the Energy Coalition, and CalCEF share a common thread — their missions relate to advancing the cause of a clean energy future in California. And while utility funding and partnership is evident in all three operations, the overarching goal is understood to be green.

But as Adler observed, the utilities themselves present one of the greatest obstacles to progress on a clean-energy transition. While California has increased renewable energy sources, it’s done a poor job at supplanting fossil fuel generation with green alternatives, in part because the CPUC has allowed for increasing fossil fuel power generation even as renewable energy expands. According to a listing on the California Energy Commission website, nine natural gas power plants have won approval statewide and are moving toward construction, while six new ones are under review.

The CalCEF approach to addressing climate change, rather than aggressively targeting polluting industries, is to encourage the fledgling green industry in hopes of facilitating success in partnership with the financial sector. In many cases, the backers of the clean-tech companies are the same players behind the big energy giants.

Environmental advocates are critical. “If anyone thinks the CPUC is set up to serve public interests, forget that,” says Al Weinrub, executive director of the Local Clean Energy Alliance, a group that organized against PG&E’s ill-fated Proposition 16 last year. “They never have and they never will.”

Weinrub said he viewed proponents of green energy as falling into two camps: Moneyed interests motivated by a growing new market sector, and activists motivated by environmental and social justice causes. Major green investment firms “want to de-carbonize capitalism,” he observed. “But everything else stays the same.”

Peevey is considered a major driver behind the state’s climate change legislation, and he’s highly regarded for his dedication to green energy. Yet as long as the interlocking dynamic between energy regulators and California’s largest utilities goes unchallenged, change will only come in a way that’s as comfortable, profitable, and manageable for the state’s top polluters as they wish. And in a state with an aging energy infrastructure that’s vulnerable to the impacts of climate change, that pace isn’t nearly quick enough.