rebeccab@sfbg.com

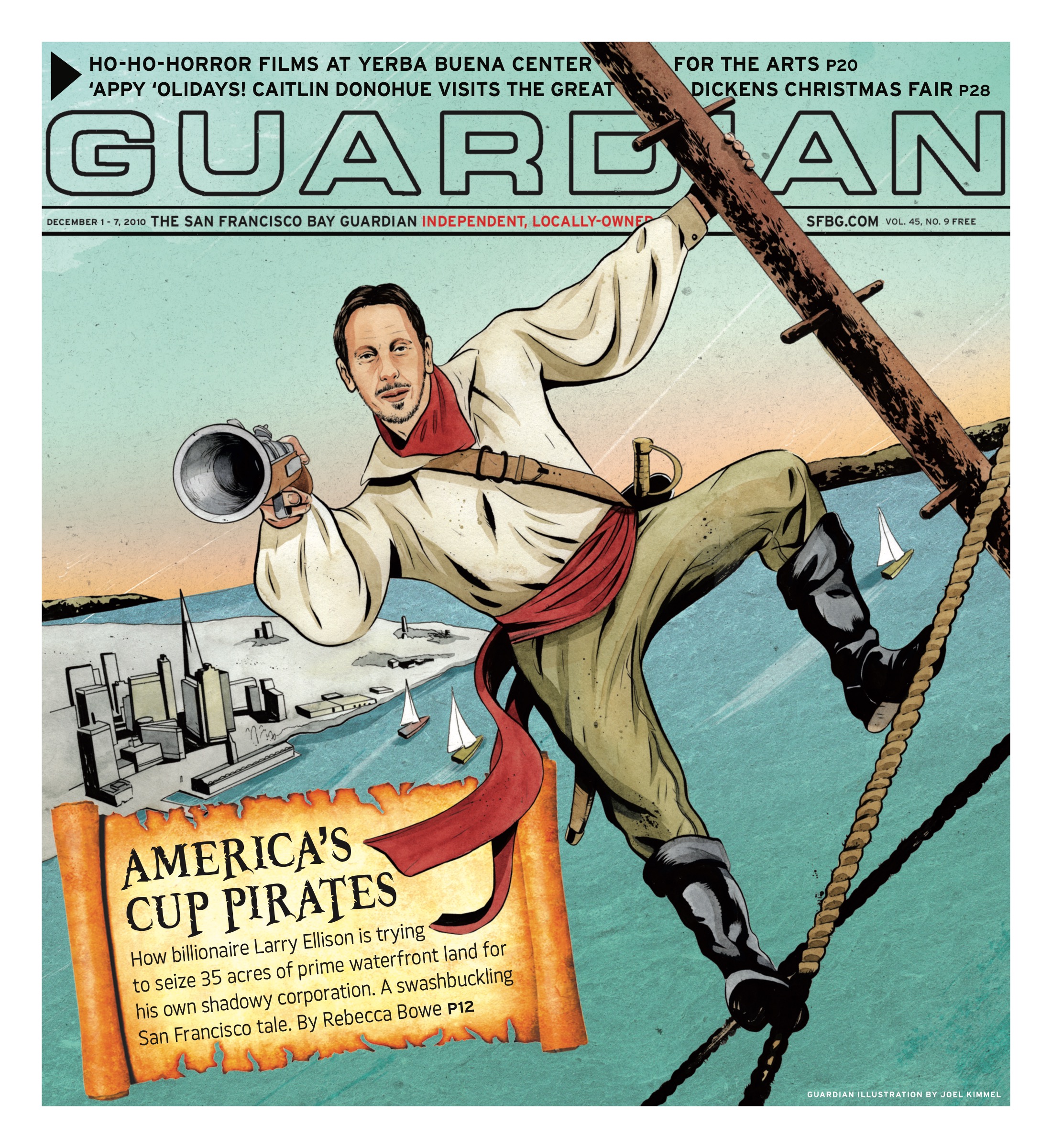

Shortly after Larry Ellison, the billionaire CEO of Oracle Corp. and owner of the BMW Oracle Racing Team, won the 33rd America’s Cup off the coast of Valencia, Spain, in February 2010, a reception was held in his honor in the rotunda at San Francisco City Hall.

The event drew members of Ellison’s sailing crew, business and political heavyweights such as former Secretary of State George Schultz, and other VIPs. Attendees posed for photographs with the tall, glittering silver trophy at the base of the grand staircase.

As part of the celebration, Ellison helped Mayor Gavin Newsom into an official BMW Oracle Racing Team jacket, and Newsom granted Ellison a key to the city, a symbolic honor usually reserved for heads of state and the San Francisco Giants after they won the World Series. Shortly after, the mayor and the guest of honor, whom Forbes magazine ranked as the sixth-richest person in the world, sat down for a face-to-face.

That meeting marked the beginning of the city’s bid to host the 34th America’s Cup in San Francisco in 2013. Since securing the Cup, Ellison has made no secret of his desire to stage the 159-year-old sailing match against the iconic backdrop of the San Francisco Bay, a natural amphitheater that could be ringed with spectators gathered ashore while media images of the stunningly expensive yachts are broadcast internationally.

Newsom and other elected officials have feverishly championed the idea, touting it as an opportunity for a boost to the region’s anemic economy. The city’s Budget & Legislative Analyst projects roughly $1.2 billion in economic activity associated with the event — the real prize, as far as business interests are concerned. It would also create the equivalent of 8,840 jobs, mostly in the form of overtime for city workers and short-term gigs for the private sector.

While the idea has won preliminary support from most members of the Board of Supervisors, serious questions are beginning to arise as the finer details of the agreement emerge and the date for a final decision draws near.

Ellison and the race organizers would be granted control of 35 acres of prime waterfront property in exchange for selecting San Francisco as the venue for the Cup and investing $150 million into Port of San Francisco infrastructure. But the event would result in a negative net impact to city coffers.

Hosting the event and meeting Ellison’s demands for property would cost the city about $128 million, according the Budget & Legislative Analyst, just as city leaders grapple with closing a projected $712 million deficit in the budget cycle spanning 2011 and 2012.

Part of the impact is an estimated $86 million in lost revenue associated with rent-free leases the city would enter into with Ellison’s LLC, the America’s Cup Event Authority (ACEA). In exchange for selecting San Francisco as a venue and investing in port infrastructure, ACEA would win long-term control of Piers 30-32, Pier 50, and Seawall Lot 330 — waterfront real estate owned by the Port of San Francisco, with development rights included. Seawall Lot 330, a 2.5-acre triangular parcel bordered by the Embarcadero at the base of Bryant Street, would either be leased long-term or transferred outright to ACEA.

The most vociferous opponent of the America’s Cup plan is Sup. Chris Daly, who has voiced scathing criticism of the notion that the city would subsidize a billionaire’s yacht race at a time of fiscal instability. “The question is whether or not the package that San Francisco’s putting together is good or bad for the city,” Daly told the Guardian, “and whether or not it’s the best deal the city can get.”

THE CREW

According to a Forbes calculation from September 2010, Ellison’s net worth is $27 billion, making him several times wealthier than the City and County of San Francisco, which has a total annual budget of about $6 billion. Ellison reportedly spent $100 million and a decade pursuing the Cup.

As soon as Ellison expressed interest in bringing the Cup to San Francisco, Newsom began charting a course. Park Merced architect and Newsom campaign contributor Craig Hartman of the firm Skidmore, Owings & Merrill was tapped to reimagine the piers south of the Bay Bridge as the central hub for the event, and soon Hartman’s vision for a viewing area beneath a whimsical sail-like canopy was forwarded to the media.

The mayor also issued letters of invitation to form the America’s Cup Organizing Committee (ACOC), a group that would be tasked with soliciting corporate funding for the event. ACOC was convened as a nonprofit corporation, and it’s a powerhouse of wealthy, politically connected, and influential members.

Hollywood mogul Steve Bing, who’s donated millions to the Democratic Party and funded former President Bill Clinton’s 2009 trip to North Korea to rescue two imprisoned American journalists, is on the committee. So is Tom Perkins, a Silicon Valley venture capitalist, billionaire, and former mega-yacht owner who was once dubbed “the Captain of Capitalism” by 60 Minutes. George Schultz and his wife, Charlotte, are members. Thomas J. Coates, a powerful San Francisco real estate investor who dumped $1 million into a 2008 California ballot initiative to eliminate rent control, also has a seat. Coates resurfaced in the November 2010 election when he poured $200,000 into local anti-progressive ballot measures and the campaigns of economically conservative supervisorial candidates.

Billionaire Warren Hellman, San Francisco socialite Dede Wilsey, and former Newsom press secretary Peter Ragone are also on ACOC. There are representatives from Wells Fargo, AT&T, and United Airlines. One ACOC member directs a real estate firm that generated $2.5 billion in revenue in 2009. Another is Martin Koffel, CEO of URS Corp., an energy industry heavyweight that made $9.2 billion in revenue in 2009. There’s Richard Kramlich, a cofounder of a Menlo Park venture capital firm that controls $11 billion in “committed capital.” And then there’s Mike Latham, CEO of iShares, which traffics in pooled investment funds worth about $509 billion, according to a BusinessWeek article.

There’s also an honorary branch of ACOC composed of elected officials including House Minority Leader Nancy Pelosi, Gov. Arnold Schwarzenegger, Sen. Dianne Feinstein, and others. Their role is to help the Cup interface with various governmental agencies to control air space, secure areas of the bay exclusively for the event, set up international broadcasts, and bring foreign crew members and fancy sailboats into the United States without a hassle from immigration authorities.

ACOC is expected to raise $270 million in corporate sponsorships for the America’s Cup. That money will be funneled into the budget for ACEA. It’s unclear whether the $150 million ACEA is required to invest in city piers will be derived from ACOC’s fund drive.

The city also anticipates that ACOC would raise $32 million to help defray municipal costs. “However,” the Budget & Legislative Analyst report cautions, “there is no guarantee that any of the anticipated $32 million in private contributions will be raised.”

A seven-member board, chaired by sports management executive Richard Worth, will direct the ACEA, according to Newsom’s economic advisors, but the other six seats have yet to be filled. ACEA’s newly minted CEO is Craig Thompson, a native Californian who previously worked with a governing body for the Olympics and has helped coordinate major sporting events internationally. In an interview with sports blog Valencia Sailing, Thompson provided some insight on why major corporations might be inspired to donate to the cause. Basically, the Cup is the holy grail of networking events.

“It’s a very difficult economic situation we are going through, and it’s not the best time to be looking for sponsors for a major event,” Thompson acknowledged. “On the other hand, the America’s Cup is one of the very few activities … that offer access to really top-level individuals in terms of education or economic situation. The America’s Cup is a unique platform for a lot of companies that want access to those individuals that are very difficult to reach under normal circumstances. I can tell you for example that Oracle is very pleased with the marketing opportunity the America’s Cup has presented to them. They invite their best customers and are very successful in turning the America’s Cup into a platform for generating business. The same thing can be true for a lot of different companies that need access to wealthy individuals.”

But should San Francisco taxpayers really be subsidizing a networking event for the some of the business world’s richest and most powerful players?

TRANSFORMING THE WATERFRONT

Over the past four months, Newsom’s Office of Economic and Workforce Development (OEWD) has been negotiating with race organizers to hash out a Host City Agreement outlining the terms of bringing the America’s Cup to San Francisco.

The proposal will go before the Board of Supervisor’s Budget & Finance Committee on Dec. 8, and to the full board Dec. 14. A final decision on whether San Francisco will host the race is expected by Dec. 31. ACEA and ACOC will each sign onto the agreement with the City and County of San Francisco.

From the beginning, the event was envisioned as “the twin transformation,” according to OEWD — the America’s Cup would be transformed by attracting greater crowds and heightened commercial interest while San Francisco’s crumbling piers would be revitalized through ACEA’s $150 million investment in port infrastructure.

The plan paints downtown San Francisco as the “America’s Cup Village” during the sailing events, and a study produced by Beacon Economics estimates that the financial boost would come primarily from hordes of visitors flocking to the event — more than 500,000 are expected to attend. The city expects a minimum of 45 race days, including one pre regatta in 2011 and one in 2012 (or two in 2012 if the one in 2011 doesn’t happen), a challenger series in 2013, and a final match in 2013.

The transformation of the city’s waterfront would be dramatic. In addition to the rent-free leases for Piers 30-32, 50, and Seawall Lot 330, ACEA would be granted exclusive use of much of the central waterfront, water, and piers around Mission Bay, and water and land near Islais Creek during the course of the event. Under the Host City Agreement, race organizers would have use of water space spanning Piers 14 to 22 ½; Piers 28, 38, 40, 48, and 54, a portion of Seawall Lot 337, and Pier 80, where a temporary heliport would be sited.

Seawall Lot 330, a 2.5-acre parcel valued by the Port at $33 million, lies at the base of Bryant Street along the Embarcadero and has a nice unimpeded view of the bay. Piers 30-32 span 12.5 acres, and Pier 50 is 20 acres.

The Budget & Legislative Analyst’s study predicts that the ACEA could opt to build a 250-unit condo high-rise on Seawall Lot 330, deemed the most lucrative use. Under the Host City Agreement, the city would be obligated to remove Tidelands Trust provisions from Seawall Lot 330, which guarantee under state law that waterfront property is used for maritime functions or public benefit. Tweaking the law for a single deal would require approval from the State Lands Commission, but Newsom, in his new capacity as lieutenant governor, would cast one of the three votes on that body.

The combination of construction, demolition, lost rent revenue, police and transit, environmental analysis, and other event costs would hit the city with a bill totaling around $64 million, according to the Budget & Legislative Analyst study. Since city government would recoup around $22 million in revenue from hosting the Cup, the net impact would be around $42 million. That doesn’t include the potential $32 million assistance from ACOC.

At the same time, the city would stand to lose another $86.2 million by granting long-term development rights to 35 acres of Port property for 66 to 75 years without charging rent, bringing the total cost to $128 million. OEWD representatives played down that loss in potential revenue, saying past attempts to redevelop piers hadn’t been successful because none could handle the upfront investment to revitalize the crumbling piers.

The Host City Agreement has raised skepticism among Port staff and the Budget Analyst that tempered initial enthusiasm for the event. “The terms of the Host City Agreement will require significant city capital investment and will result in substantial lost revenue to the Port,” a Port study determined. Faith in that plan seems to be eroding and it may be scrapped for an alternative plan that’s cheaper for the city.

The Northern Waterfront alternative substitutes Piers 19-29 as the primary location for the event and eliminates the Mission Bay piers from the equation. Under this scenario, ACEA would invest an estimated $55 million, instead of $150 million. In exchange, it would receive long-term development rights to Piers 30-32 and Seawall 330 on “commercially reasonable terms,” according to a Port staff report.

Board of Supervisors President David Chiu requested that the Port explore that second option more fully, and the Port report notes that it would reduce the strain on Port revenue. The Northern Waterfront plan would cost the Port a total of $15.8 million, instead of $43 million, the report notes. Port staff recommended in its report that both the original agreement and the alternative be forwarded to the full board for consideration.

PHANTOM BIDS?

Under the competition’s official protocol, Ellison, as defender of the Cup, has unilateral power to decide where the next regatta will be held. Race organizers have said it’s a toss-up between San Francisco and an unnamed port in Italy — though it’s anyone’s guess how seriously a European site is being considered by a team headquartered at the Golden Gate Yacht Club, a stone’s throw from the Golden Gate Bridge.

According to a San Francisco Chronicle article published in early September, Newsom issued a memo stating that San Francisco was competing against Spain and Italy to become the chosen venue. Valencia was said to be offering a “generous financial bid,” and a group in Rome was rumored to have offered some $645 million to bring the Cup to Italian shores, the memo noted. It was a call for the city to present Ellison with the most attractive deal possible to compel him to pick San Francisco.

Speaking at an Oct. 4 Land Use Committee hearing, OEWD director Jennifer Matz told supervisors: “San Francisco was designated the only city under consideration back in July. Now we are competing against the prime minister of Italy and the king of Spain.”

However, the veracity of those claims came into question in mid-November. Daly, incensed that the Mayor’s Office never communicated with him about the Cup despite wanting to hold it in his sixth supervisorial district, launched his own personal investigation. He fired off an e-mail to Team Alinghi, a prior America’s Cup winner, and began communicating with other European contacts until he got in touch with someone in Valencia’s municipal government.

“I got a call back from a representative who basically said I should know something,” Daly recounted. Valencia, his source said, never submitted a bid to host the Cup. At a Nov. 13 press conference, Valencia’s mayor Rita Barbera confirmed this claim, according to a Spanish press report, expressing disappointment that the city had been eliminated from consideration as a host venue. “There was no formal bidding process,” she charged. She also denied reports that any money had been offered.

Meanwhile, the Budget Analyst was unable to find any concrete evidence that other host city bids had been submitted. “We have nothing to confirm that other offers have been made,” Fred Brousseau of the Budget Analyst’s office told the Guardian.

In response to Guardian queries about whether the Mayor’s Office had evidence that Italy had indeed submitted a bid, Project Manager Kyri McClellan of the OEWD forwarded a one-page resolution from the Italian prime minister assuring race organizers that there would be tax breaks, accelerated approvals, and other perks guaranteed if the Cup came to Italy. However, an Italian journalist who looked over the resolution told the Guardian that the document didn’t appear to be a formal bid, merely a response to a query from race organizers.

Daly has his doubts that either Valencia or the Italian port were ever seriously considered. “I think they were phantom bids,” he said, “created by either Larry Ellison or the Newsom administration … to place pressure on the Board of Supervisors.”

A representative from OEWD told the Guardian that officials have no reason to doubt that the European bids, and accompanying offers of money, were real. However, the city wasn’t privy to race organizer’s discussions about possible European venues. A final decision is expected before the end of the year.

Daly hasn’t held back in voicing opposition to the America’s Cup and blasted it at an Oct. 5 Board meeting. “This tacking around Sup. Daly will not get you in calmer waters,” Daly said. “I told myself I was not going to make a yachting reference. But I will bring a white squall onto this race and onto this Cup, and I will do everything in my power starting on Jan. 8 to make sure these boats never see that water.”

WIND IN WHOSE SAILS?

The America’s Cup would undoubtedly bring economic benefit to the area and create work at a time when jobs are scarce. Police officers would get overtime. Restaurant servers would be scrambling to keep up with demand. Construction workers seeking temporary employment would get gigs. Hotels would rake it in. Pier 39 would be booming. However, the Budget Analyst report cautioned: “It is unlikely that any labor benefits would remain in the years after the America’s Cup event is completed.”

Certain small businesses would catch a windfall. John Caine, owner the Hi Dive bar at Pier 28, didn’t hesitate when asked about his opinion on the city hosting the Cup. “Please come fix our piers. It’s a shout-out to Larry Ellison,” he said. Caine said he supports the America’s Cup bid 100 percent, and is excited about the boost it could give his business. The Hi Dive would not be required to relocate under the proposal, he added.

At the same time, other small business would be negatively affected, particularly those among the 87 Port tenants who would be forced to relocate to make way for the America’s Cup. The Budget Analyst’s report also notes that retail businesses in the area whose services had no appeal to race-goers might suffer from reduced access to their stores, since crowding and street closures would shut out their customers.

The sailing community has rallied in support of the Cup, and Newsom has received hundreds of e-mails from yachting enthusiasts from as far away as Hawaii and Florida promising to travel to San Francisco with all their sailing friends to watch the world-famous vessels compete.

Ariane Paul, commodore of a classic wooden boat club called the Master Mariners Benevolent Association, told the Guardian that she was excited about the opportunity for the America’s Cup to showcase sailing on the bay. “In the long term, it’s a win-win,” Paul said. “It would be great to have that boost.” As for the financial terms of the deal, she remained confident, saying, “I don’t think that the city is going to let Larry Ellison walk all over them.”

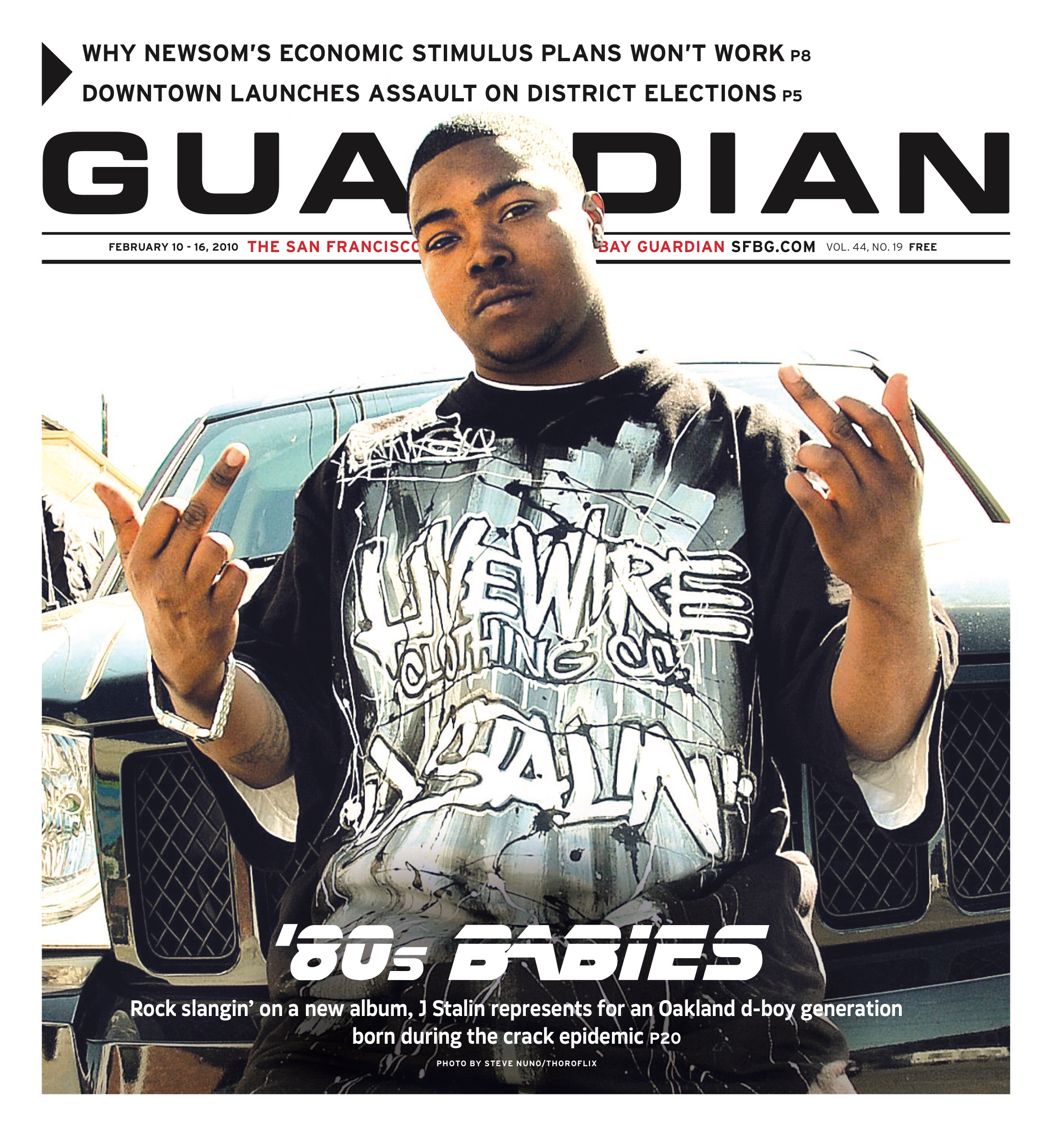

Sup. Ross Mirkarimi is often politically aligned with Daly, but not when it comes to the issue of the America’s Cup. As a kid growing up on the island of Jamestown, a tiny blue-collar community located off the coast of Rhode Island, Mirkarimi learned to sail and occasionally spent summers working as a deckhand. Every few years, the America’s Cup would come to nearby Newport, transforming the area into a bustling hub and bringing the locals into contact with famous sailors. It left an everlasting impression. When the BMW Oracle Racing Team secured the 33rd Cup off the coast of Valencia, Mirkarimi did a double-take when he saw a photograph of the winning team — his childhood friend from Rhode Island was on the crew.

Mirkarimi told the Guardian he supports bringing the Cup to San Francisco because of the economic boost the area will receive — if the Cup continues to return to San Francisco as it did for 53 years in Newport, he said, the city could look forward to a free gift in improved revenue associated with the event, and that could help quiet the tired annual debates over painful budget cuts.

At the same time, he acknowledged that the Budget Analyst report had prompted what he called healthy skepticism. “I think the onus is on the city and Cup organizers to make sure the benefits far, far outweigh the investment,” Mirkarimi said. “This effort is not just about making one of the wealthiest men in the United States that much more wealthy … That can’t be the case,” he said. “It has to be about what will the Cup do in order to be a win-win for the people of San Francisco.” Mirkarimi said he expected scrutiny of the details of the agreement at the Dec. 8 Budget and Finance Committee hearing: “Naturally, in this time of economic downturn … people want to know, what’s the outlay of cost, and what are we going to get in return?”