While business and political leaders within San Francisco continue to express optimism that the technology industry will keep growing and filling all the new office space we can build — there’s even talk in the business community about overturning Prop. M, the 1985 measure that placed limits on new office construction — the rest of the world seems more concerned that the latest tech bubble could pop.

That would hit San Francisco — where 13 percent of private sector jobs are in the tech/information sector, giving just this city more job growth since 2007 than all but three entire US states — harder than other single city in the world. San Francisco Controller’s Office has repeatedly warned how vulnerable we are to significant drop in tech valuation, even though it has also predicted that this time is different and things seem fine for the foreseeable future.

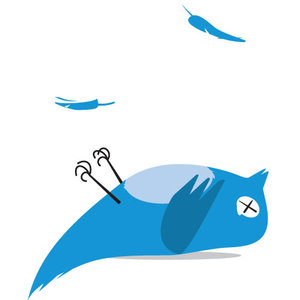

But with indicators such as Twitter’s rapidly tanking stock, the irrational exhuberance of Google and Facebook paying billions for companies with big ideas but no real business model, and total venture capital investments surpassing levels from the last dot.com crash, San Francisco could be in big trouble.

The May 2 issue of the San Francisco Business Times opens with an article about Ken Rosen, the chairman of UC Berkelely’s Fisher Center and someone who predicted the last dot.com crash when most other analysts throught the party would never end, predicting that half of the tech companies out there will fail in the next two-three years (and that was before Twitter stock fell by 18 percent just today).

“When you’re leasing to these companies, you have to remember half of them are going to go out of business,” Rosen told a gathering of real estate professionals on April 28, according to the Business Times.

Meanwhile, while tech-loving San Franciscans continue to party like it’s 1999, San Francisco city government is still facing big budget deficits because tax-cutting city officials have failed to capture our share of the wealth. And if much of that wealth evaporates, like it did last time, both the overall economic and city finances could take a deep and painful hit.

But hey, at least maybe rents would come down.