Let’s start with an assumption that I think most sane (non-libertarian, non-right-wing-GOP) people agree on: A tax system ought to be based on ability to pay, ought to avoid as much as possible special-interest breaks and should avoid the appearance and the reality of unfairness.

So as Jerry Brown tries to convince voters to approve his fall tax measure that’s part income taxes on the rich and part sales taxes on everyone, how does the state add up? The California Budget Project, which is one of my favorite organizations ever, has a couple of reports out that shed some light on why half of Brown’s plan — taxes on the millionaires — makes sense, and the other half of it doesn’t.

You can read the two reports here. Let’s start with who pays the taxes:

Measured as a share of family income, California’s lowest-income families pay the most in taxes.

Yes, many individual rich people pay more in terms of gross dollars — but when they’re done and the taxes are turned over to the government, the poor have very little left, and the rich have plenty. In fact, even with higher income tax rates, the wealthiest Californians only paid 7.4 percent of their incomes on state and local taxes. They poorest paid 10.2 percent.

Part of that comes from the inherently regressive nature of sales taxes. Part of it comes from the way different types of income are taxed (poor people don’t tend to have a lot of dividend or capital-gains income, which is taxed less than the income you earn from working all day at a job). But overall, the picture suggests that the income taxes on the wealthiest aren’t high enough.

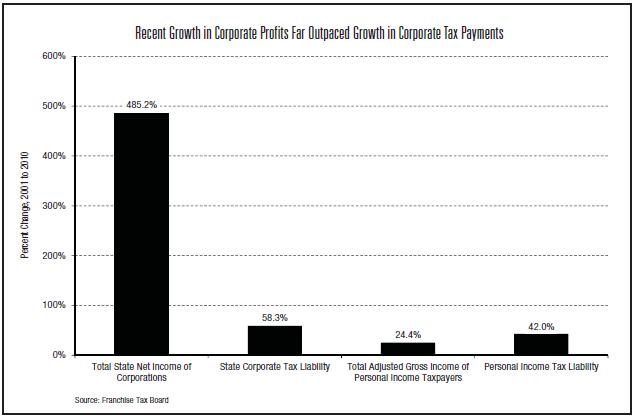

For all those types who complain that high taxes are hurting the state’s business climate, the report shows that California is pretty close to the national median in overall taxes. But it also notes that corporate income has soared relative to personal income: Over the past decade, the total reported taxable income of corporations in the state rose 485 percent. Total personal income rose 24 percent. Meanwhile, corporate tax liability rose only 58 percent, while personal liability rose 42 percent.

The result: Individual working people are paying more of the tax burden and corporations are paying less. (Unless you agree with Mitt Romney that “corporations are people.”)

Now let’s turn to the fairness report. It has some of the same data, but puts it in context:

California’s tax system is modestly regressive … [which] results from the relatively large share of income that lower-income households pay in the form of sales and excise taxes [and] the fact that low- and middle-income households spend all, or nearly all, of their incomes on necessities, including on many goods that are subject to tax.

I’m voting for the tax measure in November because the state desperately needs new revenue. But I say that recognizing that Brown’s proposal won’t do much of anything to address the basic unfairness of the way California raises the money to pay for state services.