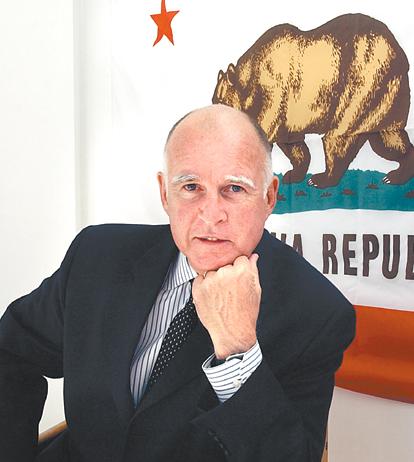

The state of the state tax measures is more and more confusing; as Calitics notes, Jerry Brown, who has a half-assed tax plan that relies too much on sales taxes, wants everyone else out of the way, but you don’t say things like that to really, really rich people, and a really rich person wants her own tax measure, which is much more progressive but earmarks the money just for schools, which isn’t particularly helpful.

And there may be more.

The always-insightful and hardly-ever wrong folks at CalBuzz say Jerry’s got to stop everyone else from cluttering the ballot, else all of the plans will fail. Which is definately CW — but it doesn’t always work that way. There were five competing ballot measures aimed at insurance reform (some of them industry fakes) in 1998, and the voters still approved the real one, Prop. 103.

But taxes are a bit different — and if the voters see the various options not as alternatives but as many ways to raise taxes higher and higher, they might all go down.

And there’s another factor here: I’m hoping that there’s a serious business-tax reform measure on the San Francisco ballot. And if there are several state tax measures (attracting intense and big-money opposition) and there’s another one on the local ballot, we might be in trouble.

Maybe Jerry should get with Molly Munger and cut a deal: The guv makes his plan more progressive, Munger helps fund it — and local governments can join in the fight to “tax the 1 percent.” Then we can all win. Maybe.