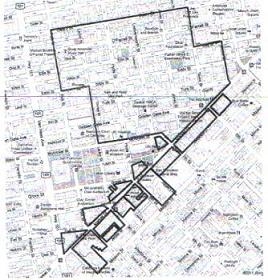

In the face of testimony that the proposed Mid-Market/Tenderloin/Twitter payroll tax exemption zone included properties that don’t need tax breaks to fill vacancies, sponsoring Sup. Jane Kim today amended the measure to exclude several large commercial properties along Market Street at the end of a long and heated hearing before the Board of Supervisors Budget & Finance Subcommittee, which then voted to continue the item for one week.

City Economist Ted Egan had recommended that change and others, including creation of a parcel tax on vacant commercial properties in order to encourage landlords to lower rents enough to attract tenants. That change would require voter approval and Kim told the Guardian that she supports the idea and has directed her staff to work on introducing that measure for the board’s consideration this year.

Yet many critics of the proposal – particularly members of the city’s biggest labor union, SEIU 1021, who criticized the city for giving millions of dollars to millionaire landlords and Twitter executives while asking low-paid city workers for salary and benefit givebacks – weren’t satisfied with those changes. They say testimony from Egan and others made clear that the tax exemption should be narrowly tailored to keep Twitter in town rather than including the entire Tenderloin, which Kim and Tenderloin power broker Randy Shaw tacked onto the original proposal.

Kim, who ran for office as a progressive, tried to counter criticism from her political base that the proposal would gentrify the area and potentially drive out low-income renters, non-profits, and small businesses, specifically asking Egan whether the proposal would increase commercial rents. Egan said it probably would: “That will exert rent pressures on a lot of the small businesses,” Egan said, adding that it would also probably drive up rents for nonprofit groups in the area, costs that could be passed on to the city taxpayers that support them. Egan also said that the proposal probably wouldn’t have any discernible economic development benefits for the Tenderloin.

But apparently Kim wasn’t paying close attention to those answers because her closing statement cast the legislation as a progressive reform aimed at helping a blighted area and small businesses, rather than the boon to landlords that critics say it is. “This is a huge boon to many of the small businesses that are struggling in this area,” Kim said, adding that, “Our office is very concerned about gentrification.”

Several community and business groups whose support had been solicited by Shaw, Kim, and the Mayor’s Office of Economic Development testified at the hearing, stating a belief that the legislation will revitalize the area and keep Twitter from leaving town. OEWD distributed a new letter from Twitter CFO Ali Rowghani stating, “I am happy to report that Twitter has signed a Letter of Intent with the Shorenstein group to lease a large block of space at the historic Furniture Mart building on Market and 9th Streets. This LOI is contingent on the Board of Supervisors’ approval of the payroll tax exemption as part of the revitalization efforts, without which Twitter would not be able to justify the cost burden of staying in San Francisco.”

Critics called it a shakedown of city taxpayers. “We’re talking about giving away $22 million to a corporation valued in the billions,” former Sup. Chris Daly said, later adding, “Someone needs to stand up to corporate threats and do the people’s work.”

Yet even critics of the deal, such as Sup. Ross Mirkarimi said, “I don’t think there’s anyone in city government that wants to see Twitter leave San Francisco.” But he questioned the many hidden costs to taxpayers of the giveaway to Twitter, such as the Muni line and police foot patrols that have been promised, asking whether they have been calculated into the cost of this deal. “We do not have a cost for these things and you do have a valid question,” replied Budget Analyst Harvey Rose.

Other critics questioned the optimistic assumptions of how much Twitter will grow, how many businesses it will attract to the area, and whether that economic activity will continue after this tax holiday expires in six years – which is the basis for Egan’s conclusion that the $22 million giveaway will eventually pay for itself.

As the board begins to weigh into its next big controversial issue, a pension reform proposal that cuts deeply into city workers’ paychecks, the symbolism of corporate tax breaks weighed heavily on the proceedings.

“It’s going to be very difficult to get our members to do anything if you do this,” Brenda Barros, an SF General worker and SEIU 1021 member told the committee. “Are you with the workers or are you with the millionaires?”

But proponents of the deal insist that it’s simply about mid-Market blight and retaining Twitter. As Board President David Chiu, whose co-sponsorship with Kim means that this is likely a done deal, said, “It’s about changing the status quo.”