news@sfbg.com

For Mao Huajun and Wen Lin, a trip to San Francisco is a chance to stock up on American retail. With at least five bags in each arm, the couple from China is all smiles. Through an interpreter, they point to the tags on their new clothes and cologne and explain: "Made in China."

Consumer products devised here and made there are too expensive or not available for Chinese shoppers, so Mao and Wen, who come from Wenzhou, where Mao made a fortune in wood products and real estate, are taking full advantage of their trip.

But don’t confuse them with typical tourists. The two are on a boutique pre-immigration tour of the Bay Area, tailored for rich people who want to move to this country — without the typical problem of getting documents.

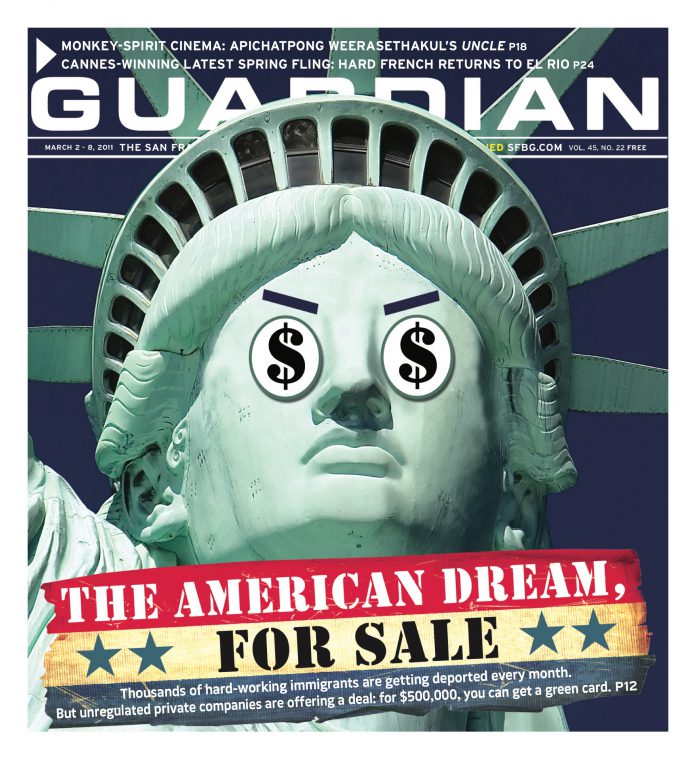

An anti-immigration wave is sweeping across the country. The Obama administration has overseen the deportation of a record 390,000 people in the past year. College kids who came here as young children are finding they can’t stay and work. The much-anticipated DREAM Act, which would allow college graduates a chance at citizenship, is in a Republican-induced limbo. Poor and working-class immigrants are getting kicked out of the country every day.

But private companies are going overseas and recruiting investors with the promise of a little-known federal program: For half a million bucks, you can get yourself a green card.

If you’ve got the cash, the promoters say it’s easy. Invest that sum with a broker who’s doing some sort of development in a low-income area and you’re guaranteed the right to move to the United States, immediately, with your entire family. You can live anywhere you want (not just in the area where you invested). And you’re on track to become a U.S. citizen.

But the program, known by its federal moniker of EB-5, is riddled with loopholes and lack of oversight. It has a history of creating few or no jobs, and the projects it funds can harm low-income communities. The immigrant investors aren’t safe, either. They put their fate in the hands of brokers and immigration officials, and if everything doesn’t go according to plan (and sometimes they have no control over that plan), they lose their money and face deportation — sometimes years after settling into their new lives.

In truth, the real winners in this program are the private brokers who profit by connecting immigrant investors with projects that desperately need funding.

San Francisco has been late to enter the EB-5 game — but now long-time political figures, including former Redevelopment Commissioner Benny Yee, are getting in on the action. Oakland has several EB-5 centers looking for money.

THE RICH ARE DIFFERENT

The federal government has long offered employment-based visas that allow people with exceptional skills or who are otherwise valuable to the American economy to immigrate to the U.S. But EB-5, created in 1990, is different: it places value on immigrants based on their wallets, not on their brains.

When Congress debated the creation of EB-5, politicians and members of the public saw it as a bona fide way to create citizenship opportunities. The rationale: people who create jobs with their money deserve to live here.

Federal officials and EB-5 experts told us how it works, at least in theory. To gain initial residence visas for themselves and their families, would-be immigrants have to invest $1 million in a new business or an existing and struggling one. If the business is in a Targeted Employment Area — defined by law as "a rural area or an area that has experienced high unemployment of at least 150 percent of the national average" — the investment requirement drops to $500,000.

The EB-5 applicants can invest on their own or they through a broker, known as a regional center. Regional centers make the process easier for investors; they also pool investment to generate the capital necessary for big projects.

Each investor must create or preserve at least 10 full-time sustainable jobs within two years to stay in the country permanently.

Exact numbers aren’t available, but government data shows that the vast majority of investors opt for the $500,000 plan — and few invest on their own. Luz Irazabal, spokesperson for United States Citizenship and Immigration Services, the agency overseeing EB-5, estimates that 80 percent to 90 percent of visas are granted through the regional centers.

So in practice, the program allows private, unregulated brokers to take the money of wealthy people and invest it in projects that are supposed to create jobs in low-income areas. It’s not necessarily a bad idea, and there’s nothing wrong with opening the most possible paths to legal residency.

But it doesn’t always work out — for the immigrants or the community.

WIN-WIN-WIN-WIN?

The EB-5 program is booming. Only 11 regional centers existed in 2007. Today 133 businesses are designated as regional centers allowed to offer EB-5 visas to foreigners in exchange for their cash and 180 applications for the status are pending.

And while EB-5 started out slowly (only a few hundred green cards were issued in the first few years) and still isn’t a huge factor in immigration (1,886 permits were issued last year), most observers agree it’s on the rise.

"As domestic money has gotten tighter, project developers have discovered the EB-5 program as a possible way to obtain foreign capital," said Stephen Yale-Loehr, a professor at Cornell University Law School, veteran immigration lawyer, and self-described "guru" of EB-5."

Some are dubious. Henry Liebman, the Seattle-based CEO of one of the oldest and most successful regional centers, told us that "most of these [new] regional centers aren’t going to raise a nickel." He added that EB-5 is "not going to be the panacea that’s going to lift us out of the great depression."

And it’s something of a Wild West. The federal agency that runs the program doesn’t regulate the regional centers once they’re approved for business. And even though the centers make loans and invest money, the Securities and Exchange Commission doesn’t monitor them. Indeed, there’s no real regulation at all.

Yale-Loehr says the program helps everyone. "Project developers can win because they can get access to capital for their projects. U.S. workers win because the EB-5 money will create jobs. U.S. taxpayers win because EB-5 money stimulates the economy and creates jobs at no expense to taxpayers. And foreign investors win because they get a green card through their investments."

Not exactly. A Dec. 22, 2010 Reuters news service report notes that "thousands of immigrants have been burned by misrepresentations that EB-5 promoters make about the program, inside and outside the United States. Many have lost not only their money, but their chance at winning U.S. citizenship."

In fact, the news service found that in 2009 "four Koreans who invested in a South Dakota dairy farm through EB-5 lost their entire investment when the price of milk collapsed and the operators of the farm stopped paying the mortgage. When the four, who had invested a total of $2 million in the dairy, tried to step in and save the venture, they discovered their partner had left their names off the title. When they tried to sue in state court, the case went nowhere."

If a project falls apart and no jobs are created, the immigrants face deportation.

And there’s little guarantee that the projects these investors fund actually create any jobs for the communities where they’re located.

Regional centers have plenty of ways to win. According to center executives, they typically charge the investors a fee for facilitating the program they charge their clients. In some cases, the immigrant investors become part owners of a business enterprise; the investors and the regional center gets paid when the business turns a profit. But it’s far more common for the regional center to lend the money for projects and collect the interest. Usually immigrant investors get paid only around 1 percent in interest and the regional center picks up the rest.

It’s certainly worked for Liebman. He owns and runs 10 regional centers with offices throughout the United States and one in Tokyo. All his investments have gone into commercial real estate. "You don’t get to be Bill Gates through EB-5, but it certainly raises your game," he said.

Yale-Leohr did say the program must be "done correctly" and that it’s no piece of cake. "It is hard to set up a project that meets all immigration and securities-related requirements."

JOBS? WHERE?

Everyone agrees that the program exists primary because it’s supposed to create jobs. "There is a lot of scrutiny of job creation because that is the foundation of the program," Irazabal said.

But that scrutiny is actually limited.

It shouldn’t be hard to determine if an investment is creating jobs in the community; either there are people working in a local business or not. But EB-5 experts told us that most of the EB-5 investment doesn’t create direct jobs. Sharon Rummery, also a spokesperson for the Citizenship and Immigration Service, said she suspects most of the jobs are indirect. But after checking with agency staff, she told us there’s no data.

The difference is critical. Say, for example, some investors build an electric car factory in a neighborhood with high unemployment. They hire 10 people to build cars, and create 10 direct jobs.

But when the workers go out to lunch and the deli counter down the street hires more help, that’s indirect job-creation — and how one specific investment creates other jobs is essentially guesswork.

Of course, the electric car factory has to buy materials and parts — say, computer chips — that might be made halfway across the country (and possibly in an area that doesn’t have high unemployment). Those jobs count, too. According Irazabal, USCIS has "no requirement for the [indirect] jobs to be in the geographic area" that is struggling economically.

The geographic flexibility USCIS allows is interesting considering that, according USCIS rules, regional centers must have "plans to focus on a geographical region within the United States and must explain how the regional center will achieve economic growth within this regional area."

The most interesting question is whether any of the indirect jobs are ever really created. And the bottom line is, USCIS never checks.

Here’s the process, according to USCIS officials. Regional centers create business plans. Then they hire consulting firms to evaluate how many indirect jobs will be created if the business plan all goes as projected. USCIS signs off on the report and the E-5 visas are approved.

The government never does its own studies or reports, never tracks actual indirect job creation, and rarely questions what the private consultants say.

Economist Peter Donahue, who runs PBI Associates in San Francisco, told us the job creation promises under EB-5 amount to a "parable." Models used to track indirect jobs "give the appearance of the science but its probably someone’s best guess," he said. "I’m not persuaded this stuff adds up."

Assumptions inherent in the models are not commonly verified, he added, and often fail to calculate the net effect of an investment, like when a new firm crowds out existing firms.

Tom Henderson, who’s setting up an EB-5 center in Oakland, told us the indirect jobs model "is all smoke and mirrors — it’s bullshit" (see sidebar).

Still, Irazabal says, "numbers don’t lie." USCIS checks that business plan and the job creation strategy is "viable, can be reproduced, and is practical. We have people whose area of specialty is looking at this."

To make things more complicated, most EB-5 money isn’t going into creating goods or services. It’s going into real estate development. And unlike a factory, a new building by itself creates barely any direct jobs.

It may have the opposite effect. High-end office development often displaces existing businesses, particularly industrial ones. And those lost jobs aren’t taken into account.

THE AMERICAN DREAM

Mao said his No. 1 reason for seeking residency in the United States is the prospect of better education for his two sons, 5 and 17.

It’s ironic. Mao’s American Dream for his children is no different from the dreams of immigrants like Shing Ma "Steve" Li, a 20-year-old nursing student in San Francisco.

Li has lived in San Francisco since he was 12. speaks Cantonese, English, French and Spanish. He was arrested Sept. 15, 2010 by ICE agents, held in a detention center for two months, and threatened with deportation because his parents lacked the proper documentation.

Li, like tens of thousands of others, has talent and education and a lot to offer the United States. But he doesn’t have $500,000.

Immigration activists like Ali Noorani, executive director of the National Immigration Forum, aren’t against EB-5 just because its immigrants are privileged. "We don’t believe there are good immigrants or bad immigrants when it comes to folks who contribute to this nation," he said.

But, he added, "We are looking for equity in our immigration system."

Immigrant-rights activists properly support almost any program that helps open the doors, particularly at a time when the right-wing is exploiting anti-immigrant sentiment. But it seems unfair that one class of immigrants, the ones with large sums of extra money to invest, are getting recruited to come to the U.S. while a much larger group — including people who have lived here for years, worked hard, built businesses and contributed to the nation — is being shown the exit door.

Francisco Ugarte, an attorney with the San Francisco Immigrant Legal and Education Network, made the point: "We disagree with legal standards that make it easier for rich people to immigrate than poor people.

"Our legal system is designed to protect the rich and powerful," he added. "People who are coming out of necessity have a much harder time immigrating than wealthy people looking to move."

"It is," he added, indicative of a broken immigration system." *

EB-5 COMES TO SAN FRANCISCO

Tom Henderson’s clients call San Francisco jiou jin shan, meaning "old gold mountain" in Mandarin and referring to the Gold Rush era impression that San Francisco must be awash in opportunity.

His soon-to-be-unveiled San Francisco Regional center is still waiting on final government approval, but Henderson has already been lining up investors to participate in the program.

He spends a third of his year in China and has done business there for decades. Armed with an international network of business relationships and a quirky charisma, Henderson has won over people like Mao Huajun, low profile but extremely wealthy potential investors with sights on America.

Although more than 20 regional centers are certified to do work in Southern California, only a handful are operating in the Bay Area — although applications for more regional centers are in the pipeline.

Featured prominently on the website of the Synergy Regional Center are two prominent local figures: former Mayor Willie Brown and former Redevelopment Commission member Benny Yee.

The website has pictures of the Synergy management "meeting former San Francisco Mayor Willie Brown, to discuss about how EB-5 investment can stimulate the local economy."

Yee is listed as one of six principals at the firm. He didn’t return our phone calls seeking comment. Neither did Brown (who, to be fair, may have simply been part of a photo op since it appears the picture was taken at a fund-raising event for his institute).

According to Synergy CEO Simon Jung, Yee joined after initially "giving [Jung] advice on how to do business. He can help us bring deals in San Francisco we don’t have access to otherwise."

James Falaschi heads the Bay Area Regional Center in Oakland. His website that features three potential projects — all real estate developments in downtown and east Oakland.

Sunfield Development is the company building at the Fox Uptown and at Seminary and Ninth streets, two of the projects the Bay Area Regional center is working on. Sunfield CEO Sid Afshar said EB-5 is "a very good idea because it is a win-win for everyone."

The new player on the scene is Henderson, and he is unveiling an EB-5 vision with a lot of promise.

Mao was bombarded with options when he first heard of EB-5. As a savvy businessman, he was wary of jumping into something sketchy. Through an interpreter, he told us he went with Henderson because he "can see the way Tom is doing this business is transparent, so [he] know[s] the step by step."

Henderson has yet to reveal what his projects will be, but he says they are all businesses, not real estate projects. He said all the companies he is setting up will inhabit industries the city has identified as central to Oakland’s economic growth.

"I was born in Oakland. I work in Oakland. I live in Oakland," he said. "I won’t do projects that don’t create direct jobs."