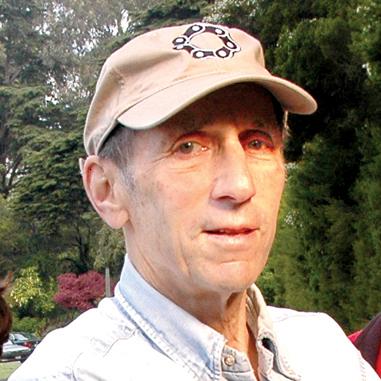

I couldn’t reach financier Warren Hellman before I wrote my column in this week’s paper talking about the employee pension discussions. But he called me yesterday (Feb. 16) after he’d seen it, and I expected he’d give me some shit.

Wrong.

In fact, Hellman had only one problem with my analysis: “Your article is didn’t go far enough.” Turns out he thinks I was a bit too easy on the billionaires.

“When you compare upper-echelon tax rates [in America] to any developed country in the world,” Hellman said, “the rich pay very low taxes here. You’re article is exactly correct — the wealthy are undertaxed.” He told me that he’s stopped trying to amass more personal wealth (“it’s all going into a foundation”) because he realizes that he couldn’t possibly spend all the money he has “and all that happens if you leave it all to the next generation is that you spoil your kids.”

Quite a statement coming from one of the city’s richest and most influential business leaders.

Of course, putting all the money in a foundation isn’t the only answer. The only way to address the wealth gap, and the decline in social, education and infrastructure spending, to for the government to get more involved — and that means collecting more tax money from the people who can afford to pay it. Hellman told me that he’s not about to accept a reduction in his lifestyle — but we both agreed that he doesn’t have to. He could pay a lot more in taxes and still be really, really rich.

So we talked about my proposal, which goes like this:

I’ve got a suggestion for the pension reform negotiators. Why not talk a little about parity.

Yes, pensions have to be fixed; let’s start at the top. Maybe nobody should have a pension of more than $100,000 a year; certainly, a former police chief shouldn’t get $250,000 a year for life. Maybe the highest-paid city employees should have to pay more into the pension system to protect the pensions of the people who make less. I could easily support progressive pension reform that would save the city money.

I just think tax reform should also be part of the equation.

Hellman wants $300 million in pension savings? Good — how about pairing it with $300 million in new taxes on the wealthy? How about big business and rich people give up something this time around, instead of all of the cuts falling on public employees and poor San Franciscans?

And Hellman, to his credit, didn’t disagree with the concept. His problem he said, was with the politics. “Taxes are the third rail of politics,” he said. “I’ve gotten my head handed to me three times now when I’ve supported tax increases.”

But I still think there’s a way to move forward here. The city employee unions agree to some sort of pension reform, which starts with a pension cap and higher payments from higher earners (not with what amounts to a pay cut for lower-wage employees who have already taken pay cuts in the past few years). Then Hellman, Mayor Ed Lee and Sup. Sean Elsbernd agree to support a progressive tax measure that would bring in badly needed revenue for public services and education.

It’s possible that the tax measure would have to wait until Nov. 2012, when it would only require a 50 percent vote. Maybe both measures go on that ballot. And Hellman, Elsbernd and Lee use their clout with downtown to push the Chamber of Commerce and the Commitee on JOBS to at least stay neutral and cut off any big-money campaign against the tax measure. Then they all agree to help raise money and campaign to pass it. And labor agrees to work for both measures.

Hellman said he feared that “one would kill the other” and both measures might fail. But I believe the people of San Francisco are willing to support new taxes — progressive new taxes — if they don’t think the money’s going to waste. And pairing pension refrom with new taxes sends a strong message: We’re all sharing the pain. Particularly if Hellman, Elsbernd and Lee can sell the tax package part of the deal to the business community.

It’s worth a try. Because otherwise, we’re going to have another Prop. B battle, both sides are going to spend a ton of money, and nobody’s going to walk away happy.

“It’s worth thinking about,” Hellman told me. I hope so.