news@sfbg.com

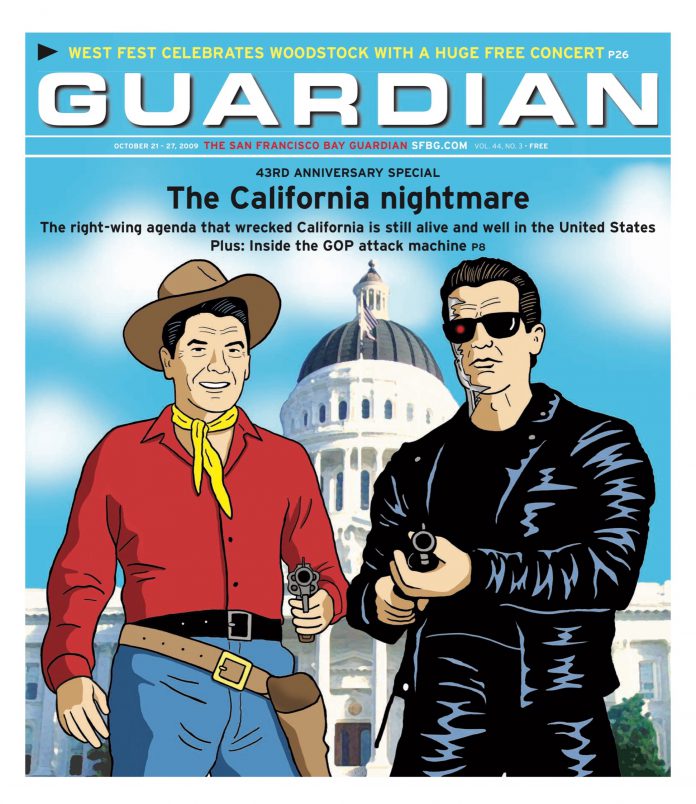

Much of the right-wing agenda that has thrown this nation into economic chaos can be traced back to what was once called the Golden State.

The tax revolts that started here under Gov. Ronald Reagan and continued to sweep the country and the world under President Reagan never abated. Indeed, they have only been strengthened by the big business power that created and benefited from them.

But now that California is showing signs of being the country’s first failed state — caught in fiscal freefall and mired in political gridlock as a generation’s worth of neglected problems surge to the surface — this state has become a cautionary tale for that anti-government ideology.

Trends in America tend to start out west, and the economic and political disaster that California has become contains critical lessons for the rest of the country.

Lewis Uhler — president and founder of the National Tax Limitation Committee — speaks candidly and proudly of his key early role in helping build a conservative movement to limit the size of government and do battle with those who want the public sector to actively promote social and economic justice.

Uhler, a UC Berkeley Boalt Hall School of Law graduate who did legal work for conservative causes in the 1960s, was tapped by then-Gov. Reagan in 1970 to be the director of the Office of Economic Opportunity, a federally-funded legal assistance program created as part of President Lyndon Johnson’s war on poverty.

While that may seem like a strange role for an avowed conservative and former member of the John Birch Society, Uhler says Reagan basically brought him in to wreck the program and fight the feds. “I was asked to put my money where my mouth was for my conservative philosophy,” Uhler told the Guardian. “OEO was set up to ensure conflict and confrontation … The mission of legal services was to change public policy through lawsuits they decided to file. I thought it was a corruption of the legal system.”

At the time, public-interest law and liberal economic and social policies were on the rise in California and spreading to the rest of the nation. So the Reaganites fought back.

Rather than helping poor plaintiffs file environmental, consumer protection, equal rights, or other types of lawsuits designed to level the playing field with powerful interests, Uhler blocked lawsuits brought by attorneys he calls “ambulance-chasers” and gutted the program. “Ultimately,” he said, “we vetoed funding for California Rural Legal Assistance.”

And for his efforts, Uhler was rewarded with a cabinet-level position: assistance secretary of the Health and Welfare Agency. Again, his role wasn’t to make the agency more effective, but to make it less effective in a realm where he believes government was too big and too active.

“The problem was uncontrolled state and local spending,” Uhler said. “Intuitively, everyone who gathered around Reagan shared the same philosophy that government doesn’t really contribute anything to economic growth.”

In 1972, Reagan gave Uhler the opportunity to work more directly on the mission of cutting taxes and shrinking the size of government, naming him chair of the Governor’s Tax Reduction Task Force. It was, in many ways, the beginning of the vast right-wing conspiracy.

“I asked to be given the chance to go across the country and find the best free market minds in the country to develop these policies,” Uhler said, explaining that he wanted to borrow the liberal strategy of giving an academic veneer to their ideas, as presidents Kennedy and Johnson had done in the realm of foreign policy. “Our side had never really done that.”

Uhler’s first stop was the University of Chicago School of Economics, where he met with noted free market economists Milton Friedman, James Buchanan, and George Stigler, who were brought into the cause.

Today’s vast network of conservative think tanks didn’t exist at that time, so Uhler tapped conservative thinkers from the American Enterprise Institute and the Hoover Institute at Stanford University, as well as other conservative economists such as Peter Drucker from Claremont McKenna College.

“There were 35 people who helped us design the first effort at a constitutional initiative in California to limit year-over-year growth of the state’s general fund,” Uhler said. “All of us as free market enthusiasts and economists all shared the belief that government beyond a certain level eats the seed corn of the nation and doesn’t produce anything.”

While voters narrowly rejected their group’s first effort to cap government growth — Proposition 1 on the November 1973 ballot — the ground had been prepared and the seeds had been sown for the tax revolts that would sweep the country in the late 1970s, with many of the campaigns coordinated by Uhler and the organization he formed for that purpose in 1975, the National Tax Limitation Committee, and a rapidly growing network of similar, interconnected organizations.

As Uhler worked with Reagan to weaken California’s government from within, his fellow travelers were developing national and international strategies to create aggressive, coordinated, well-funded campaigns to attack government and spread the free market dogma.

In August 1971, Lewis Powell — a conservative corporate attorney who President Richard Nixon had just nominated to the U.S. Supreme Court (where he served from 1972-87) — wrote a confidential memorandum to the leadership of the U.S. Chamber of Commerce titled “Attack on the American Free Enterprise System.”

He sounded the alarm that the ascendant environmental and consumer movements were going to destroy capitalism in the country unless corporate America aggressively fought back in a coordinated fashion, which he spelled out in great detail.

He called for all major corporations to develop aggressive legal and public relations strategies for fighting the left, creation of a network of think tanks and media outlets to push the conservative message, manipulation of the legal system, and sponsorship of university programs to study conservative ideas and incubate future leaders — which all came to pass in the coming decades.

“American business [is] ‘plainly in trouble’; the response to the wide range of critics has been ineffective and has included appeasement: the time has come — indeed, it is long overdue — for the wisdom, ingenuity, and resources of American business to be marshaled against those who would destroy it,” Powell wrote.

Part of that strategy involved having the federal government promote and popularize free market economic theories being developed by Friedman and his colleagues at the University of Chicago, a movement that is well-documented by journalist Naomi Klein in her book The Shock Doctrine: The Rise of Disaster Capitalism.

In 1971, Friedman and his colleagues began working with rich conservatives in Chile who were allied with Gen. Augusto Pinochet, who in turn were conspiring with the CIA to overthrow and assassinate the democratically elected, leftist President Salvador Allende, which they successfully did on Sept. 11, 1973.

Friedman’s economic theories called for a radical restructuring of society — slashing taxes and social spending; removing most regulation and trade restrictions; crushing labor unions; promoting economic growth at any cost — and Pinochet executed the strategy in brutal fashion, ordering the death of at least 3,200 of his political opponents, including the car-bomb assassination of economist Orlando Letelier in Washington, D.C., in 1976.

Friedman and Pinochet consulted openly and shared a basic disdain for social programs and progressive taxation. “The major error, in my opinion,” Friedman wrote in a letter to Pinochet in 1975, referring to the government antipoverty programs Pinochet dismantled, was “to believe that it is possible to do good with other people’s money.”

The model Pinochet and Friedman developed in Chile would eventually go global — promoted by its top cheerleaders, Reagan and British Prime Minister Margaret Thatcher — and be implemented (with disastrous results for most citizens but creating huge profits for wealthy individuals and corporations) in Indonesia, Bolivia, Argentina, Peru, Russia, Poland, South Africa, Japan, and elsewhere.

But with the corporate media and conservative opinion-shapers focused mostly on economic growth — ignoring persistent poverty and the brutal tactics used to suppress the popular movements that tried to resist Friedman’s “economic shock therapy” — Friedman had become a sort of free-market prophet by the time he died in 2006.

“In the torrent of words written in eulogy to Milton Friedman, the role of shocks and crises to advance his worldview received barely a mention,” Klein wrote. “Instead, the economist’s passing provided an occasion for a retelling of the official story of how his brand of radical capitalism became government orthodoxy in almost every corner of the globe.”

California’s fiscal shackles have been in place since 1978, when Proposition 13 and subsequent measures capped property taxes and required an undemocratic two-thirds vote to either raise taxes or pass the annual budget.

A Republican landlord lobbyist named Howard Jarvis charged onto the field that Reagan, Uhler, and their team had prepared and took advantage of a gaping hole in political leadership to set off a movement that would cripple the United States of America.

There was some logic to it then. Times were good in California in the 1970s, good enough that people were flocking to the state by the millions. That was driving up property values — and thus property taxes.

Jarvis bought his home for $8,000 in 1946; 30 years later, it was assessed at $80,000. In fact, inflation was running at close to 10 percent a year in California. Homeowners were getting huge tax hikes each year, and tenants were getting huge rent hikes at a time when state government had a budget surplus.

Homeowners saw millions of dollars sitting in the coffers in Sacramento while they couldn’t pay their tax bills. Yet nobody in the Legislature or governor’s office came up with a solution.

So when Jarvis showed up with petitions to roll back property taxes and prevent future increases, he found a broad base of support. Even tenants went along — Jarvis and his gang promised that property-tax cuts would be passed on to tenants and would mean the end of the escautf8g rent hikes.

Jarvis collected signatures for a radical measure that essentially blocked all property tax increases and allowed new assessment only when a parcel sold. It was, in the end, a huge tax giveaway to major corporations. Since commercial property turned over far less often than residential property (and since commercial sales could be hidden as stock transfers), big businesses wound up paying far less of the state’s tax burden. Corporations used to pay about two-thirds of the state’s property taxes, and individuals one-third; now that is reversed.

It didn’t help tenants, either. Few of the landlords who saw the benefits of Prop. 13 passed the money along to their renters. Most just kept it. San Francisco activist Calvin Welch likes to say that Howard Jarvis was “the father of rent control.”

The campaign against Prop. 13 warned of the dangers of cutting local government; police and fire chiefs appeared in ads opposing it. But the No on 13 folks never talked about the huge windfall big corporations would get from the measure, or the huge disparities in wealth that would be created by defunding government and dereguutf8g corporations.

If the goal was to skew the concentration of wealth in the state, it worked brilliantly. According to the California Budget Project (CBP) of the Franchise Tax Board, recent data taken before the current economic recession illustrates an ever-widening chasm between the wealthiest taxpayer and the working-class person.

The total adjusted personal income for Californians rose by nearly $64 billion in 2006-07 — with approximately three-quarters of that increase going to the top fifth of wealthiest taxpayers, and 30 percent going to the top 1 percent. That left only $19 billion for everyone else.

“The average taxpayer in the top 1 percent experienced a $128,261 increase in AGI [adjusted gross income] between 2006 and 2007, which was more than three times the total AGI of the average middle-income taxpayer in 2007 ($36,115),” stated the June 2009 report.

This continues a long-term trend in which the wealthy continue to leave the average income-earner behind in a trail of dollar-sign dust. From 1995 to 2007, income gains for that top 1 percent come to a whopping 117.3 percent increase — nearly 13 times more than the gains of the middle-income taxpayer.

The nation’s income gap has reached a “level higher than any other since 1917,” according to a paper by University of California, Berkeley economic professor Emmanuel Saez. According to Saez’s analysis of census data, there’s been a steady increase in the income gap since the 1970s, rising 20 percent over the years.

Yet even today, the defenders of Prop. 13 continue to sound the same consistent themes. “Those who are directly involved in government are a militant special interest,” Howard Jarvis Taxpayer Association executive director Kris Vosburgh told us. “They don’t like anything that limits their revenue stream.”

While that last statement could be applied equally to corporations or other private sector enterprises, as Vosburgh reluctantly admitted when asked, he continues to imply malevolence to those who defend government. He said the state’s current fiscal collapse can only be solved by slashing government expenditures.

“It is not valid to be talking about revenue-side solutions,” he said. “Our position is the state has enough money to accomplish its goals.”

People have never liked paying taxes, but the antitax movement is about far more than just that basic individual desire to hold onto our money.

The attacks were well planned, carefully targeted, and part of a much larger effort aimed at maintaining corporate and conservative power, undermining the New Deal, reducing taxes on the rich, and radically reducing the size and scope of the public sector.

As Powell called for, corporations have aggressively challenged, in legal courts and those of public opinion, every significant progressive advance — from San Francisco’s attempt at universal health care to California’s tentative first steps to address global warming.

With a level of discipline unheard of on the left, conservative opinion-shapers pound their talking points and enforce party unity through mechanisms like the “no new taxes” pledge that every Republican in the California Legislature has signed and heeded, under the very real threat of recall.

Opposition to taxes is now so deeply embedded into the psyche of the California electorate, and such a core tenet of today’s Republican Party, that elected officials who tout fiscal responsibility allowed the state’s debts to go unpaid (destroying its credit rating in the process) and its education and transportation systems to be decimated rather considering new revenues.

Gov. Arnold Schwarzenegger’s spokesperson Aaron McLear told us, “He believes we ought to live within our means and pay for only the programs we can afford.”

That simple talking point gets repeated no matter how the question is asked, or when we point out that it means we’re being forced to live within historic lows this year. But they claim the people support them.

“We had tax increases on the May ballot and they were rejected by a 2-1 margin. We should listen to the will of the voters,” McLear said.

Never mind that this regressive, dishonest package of temporary tax hikes was opposed by the Guardian and a variety of pro-tax progressive groups. McLear wouldn’t even admit that point or respond to it honestly.

And he’s certainly right that most polls show a majority of Californians don’t want new taxes. But these polls also show that people want continued government services, more investment in our neglected state infrastructure, and a whole bunch of other contradictory things.

That’s why newspapers and analysts around the world are looking at California, the world’s eighth largest economy, and wondering (as the Guardian of London headline asked Oct. 4): “Will California become America’s first failed state?”

In many ways, it already is. The question now is whether we’ll try to learn from and correct our mistakes. Ryan Riddle contributed to this report. ———–

THE CONSERVATIVE RELIGION

When I asked Lewis Uhler, one of the architects of the Reagan revolution, what Americans believed in these days — where the people he likes to talk about who hate the government (but are also admittedly disillusioned with Wall Street) turn — he answered simply: religion.

It should come as no surprise that many religious fundamentalists tend to side with the free market conservatives — both ideologies require a leap of faith and ignoring certain troubling facts, such as increasing disparities of wealth, natural resource depletion, and global warming.

Their arguments mostly make sense — until these inconvenient truths come up.

Certainly, turning over more public resources to free market capitalists, cutting taxes, and slashing government regulation will spur private sector economic growth, just as advocates claim.

But that growth has a cost. The wealth won’t be shared by everyone. Indeed, poverty has persisted even through even the economic boom of the 1990s — but almost everyone will be affected by underfunded road, education, public safety, and other essential systems.

As the conservative movement has successfully limited taxes and cut regulation over the last 40 years, working class wages have stagnated as the rich have gotten richer. Many of the world’s oil reserves have peaked and gone into decline, and rapidly increasing carbon emissions have collected in the atmosphere and caused global warming.

So how do conservatives respond to these realities as they argue for the continued dismantling of government, which is the only entity with the scope and incentive to deal with these problems? They simply deny them.

Uhler decried the “pseudoscience of climate change” as hindering economic progress and claimed that there’s actually been a global cooling trend in the last 10 years. (Actually the last 10 years have been some of the hottest on record, causing glaciers around the world to melt, according to data and observations from a consensus of the world’s climate scientists, including NASA, the Union of Concerned Scientists, and the United Nations Climate Change Conference.)

It’s the same story with the consolidation of wealth, which hurts the free market fantasy that letting the super-wealthy keep more money will eventually trickle down to benefit us all. Uhler simply denied the growing disparity of wealth, saying the “movement between quintiles is significant.”

He was talking about people’s ability to go from poor to rich with a little hard work and initiative, the core idea of free market conservatives. But data from the U.S. Census Bureau and many other entities indicate that median wages have been stagnant for decades (which wouldn’t be true if there was lots of upward mobility) and that most of the wealth created in the U.S. over the last 40 years has pooled with the top 1 percent.

In fact, when it comes to measuring social impacts, Uhler has simply one metric: “Governments at all levels are twice the size they should be to maximize economic growth.” (Steven T. Jones)