news@sfbg.com

The Occupy movement that spread across the country last fall has already changed the national discussion: It’s brought attention to the serious, systemic problem of gross inequities of wealth and power and the mass hardships that have resulted from that imbalance.

Occupy put a new paradigm in the political debate — the 1 percent is exploiting the 99 percent — and it’s tapping the energy and imagination of a new generation of activists.

When Adbusters magazine first proposed the idea of occupying Wall Street last summer, kicking off on Sept. 17, it called for a focus on how money was corrupting the political system. “Democracy not Corporatocracy,” the magazine declared — but that focus quickly broadened to encompass related issues ranging from foreclosures and the housing crisis to self-dealing financiers and industrialists who take ever more profits but provide fewer jobs to the ways that poor and disenfranchised people suffer disproportionately in this economic system.

It was a primal scream, sounded most strongly by young people who decided it was time to fight for their future. The participants have used the prompt to create a movement that drew from all walks of life: recent college graduates and the homeless, labor leaders and anarchists, communities of colors and old hippies, returning soldiers and business people. They’re voicing a wide variety of concerns and issues, but they share a common interest in empowering the average person, challenging the status quo, and demanding economic justice.

We chronicled and actively supported the Occupy movement from its early days through its repeated expulsions from public plazas by police, particularly in San Francisco, Oakland, and Berkeley. We supported the right of the protesters to remain — even as we understood they couldn’t and shouldn’t simply stay forever. Occupy needed to evolve if it was to hold the public’s interest. The movement would ultimately morph into something else.

That time has come. This spring, Occupy is poised to return as a mass movement — and there’s no shortage of energy or ideas about what comes next. Countless activists have proposed occupying foreclosed homes, shutting down ports and blocking business in bank lobbies. Those all have merit. But if the movement is going to challenge the hegemony of the 1 percent, it will involve moving onto a larger stage and coming together around bold ideas — like a national convention in Washington, D.C. to write new rules for the nation’s political and economic systems.

Imagine thousands of Occupy activists spending the spring drafting Constitutional amendments — for example, to end corporate personhood and repeal the Citizens United decision that gave corporations unlimited ability to influence elections — and a broader platform for deep and lasting change in the United States.

Imagine a broad-based discussion — in meetings and on the web — to develop a platform for economic justice, a set of ideas that could range from self-sustaining community economics to profound changes in the way America is governed.

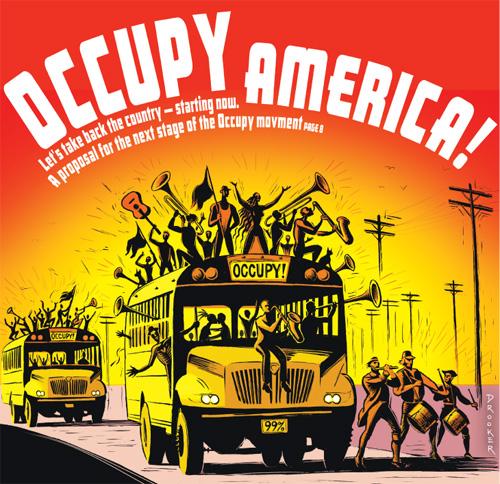

Imagine thousands of activists crossing the country in caravans, occupying public space in cities along the way, and winding up with a convention in Washington, D.C.

Imagine organizing a week of activities — not just political meetings but parties and cultural events — to make Occupy the center of the nation’s attention and an inspiring example for an international audience.

Imagine ending with a massive mobilization that brings hundreds of thousands of people to the nation’s capitol — and into the movement.

Occupy activists are already having discussions about some of these concepts (see sidebar). Thousands of activists are already converging on D.C. right now for the Occupy Congress, one of many projects that the movement can build on.

DEFINING MOMENTS

Mass social movements of the 20th Century often had defining moments — the S.F. General Strike of 1934; the Bonus Army’s occupation of Washington D.C.; the Freedom Rides, bus boycotts and Rev. Martin Luther King Jr.’s March on Washington; Earth Day 1970; the Vietnam War teach-ins and moratoriums. None of those movements were politically monolithic; all of them had internal conflicts over tactics and strategies.

But they came together in ways that made a political statement, created long-term organizing efforts, and led to significant reforms. Occupy can do the same — and more. At a time of historic inequities in wealth and power, when the rich and the right wing are stealing the future of generations of Americans, the potential for real change is enormous.

If something’s going to happen this spring and summer, the planning should get under way now.

A convention could begin in late June, in Washington D.C. — with the goal of ratifying on the Fourth of July a platform document that presents the movement’s positions, principles, and demands. Occupy groups from around the country would endorse the idea in their General Assemblies, according to procedures that they have already established and refined through the fall, and make it their own.

This winter and spring, activists would develop and hone the various proposals that would be considered at the convention and the procedures for adopting them. They could develop regional working groups or use online tools to broadly crowd-source solutions, like the people of Iceland did last year when they wrote a new constitution for that country. They would build support for ideas to meet the convention’s high-bar for its platform, probably the 90 percent threshold that many Occupy groups have adopted for taking action.

Whatever form that document takes, the exercise would unite the movement around a specific, achievable goal and give it something that it has lacked so far: an agenda and set of demands on the existing system — and a set of alternative approaches to politics.

While it might contain a multitude of issues and solutions to the complicated problems we face, it would represent the simple premise our nation was founded on: the people’s right to create a government of their choosing.

There’s already an Occupy group planning a convention in Philadelphia that weekend, and there’s a lot of symbolic value to the day. After all, on another July 4th long ago, a group of people met in Philly to draft a document called the Declaration of Independence that said, among other things, that “governments … deriv[e] their just powers from the consent of the governed … [and] whenever any Form of Government becomes destructive of these ends, it is the Right of the People to alter or to abolish it, and to institute new Government, laying its foundation on such principles and organizing its powers in such form, as to them shall seem most likely to effect their Safety and Happiness.”

ON THE ROAD

If the date is right and the organizing effort is effective, there’s no reason that Occupy couldn’t get close to a million people into the nation’s capital for an economic justice march and rally.

That, combined with teach-ins, events and days of action across the country, could kick off a new stage of a movement that has the greatest potential in a generation or more to change the direction of American politics.

Creating a platform for constitutional and political reform is perhaps even more important than the final product. In other words, the journey is even more important than the destination — and when we say journey, we mean that literally.

Occupy groups from around the country could travel together in zig-zagging paths to the Capitol, stopping and rallying in — indeed, Occupying! — every major city in the country along the way.

It could begin a week or more before the conference, along the coasts and the northern and southern borders: San Francisco and Savannah, Los Angeles and New York City, Seattle and Miami, Chicago and El Paso, Billings and New Orleans — Portland, Oregon and Portland, Maine.

At each stop, participants would gather in that city’s central plaza or another significant area with their tents and supplies, stage a rally and general assembly, and peacefully occupy for a night. Then they would break camp in the morning, travel to the next city, and do it all over again.

Along the way, the movement would attract international media attention and new participants. The caravans could also begin the work of writing the convention platform, dividing the many tasks up into regional working groups that could work on solutions and new structures in the encampments or on the road.

At each stop, the caravan would assert the right to assemble for the night at the place of its choosing, without seeking permits or submitting to any higher authorities. And at the end of that journey, the various caravans could converge on the National Mall in Washington D.C., set up a massive tent city with infrastructure needed to maintain it for a week or so, and assert the right to stay there until the job was done.

The final document would probably need to be hammered out in a convention hall with delegates from each of the participating cities, and those delegates could confer with their constituencies according to whatever procedures they prescribe. This and many of the details — from how to respond to police crackdowns to consulting of experts to the specific scope and procedures of this democratic exercise — would need to be developed over the spring.

But the Occupy movement has already started this conversation and developed the mechanisms for self-governance. It may be messy and contentious and probably even seem doomed at times, but that’s always the case with grassroots organizations that lack top-down structures.

Proposals will range from the eminently reasonable (asking Congress to end corporate personhood) to the seemingly crazy (rewriting the entire U.S. Constitution). But an Occupy platform will have value no matter what it says. We’re not fond of quoting Milton Friedman, the late right-wing economist, but he had a remarkable statement about the value of bold ideas:

“It is worth discussing radical changes, not in the expectation that they will be adopted promptly, but for two other reasons. One is to construct an ideal goal, so that incremental changes can be judged by whether they move the institutional structure toward or away from that ideal. The other reason is very different. It is so that if a crisis requiring or facilitating radical change does arrive, alternatives will be available that have been carefully developed and fully explored.”

After the delegates in the convention hall have approved the document, they could present it to the larger encampment — and use it as the basis for a massive rally on the final day. Then the occupiers can go back home — where the real work will begin.

Because Occupy will wind up spawning dozens, hundreds of local and national organizations — small and large, working on urban issues and state issues and national and international issues.

WASHINGTON’S BEEN OCCUPIED BEFORE

The history of social movements in this country offers some important lessons for Occupy.

The notion of direct action — of in-your-face demonstrations designed to force injustice onto the national stage, sometimes involving occupying public space — has long been a part of protest politics in this country. In fact, in the depth of the Great Depression, more than 40,000 former soldiers occupied a marsh on the edge of Washington D.C., created a self-sustaining campground, and demanded that bonus money promised at the end of World War I be paid out immediately.

The so-called Bonus Army attracted tremendous national attention before General Douglas Macarthur, assisted by Major George Patton and Major Dwight Eisenhower, used active-duty troops to roust the occupiers.

The Freedom Rides of the early 1960s showed the spirit of independence and democratic direct action. Raymond Arsenault, a professor at the University of South Florida, brilliantly outlines the story of the early civil rights actions in a 2007 Oxford University Press book (Freedom Rides: 1961 and the Struggle for Racial Justice) that became a national phenomenon when Oprah Winfrey devoted a show and a substantial online exhibition to it.

Arsenault notes that the rides were not popular with what was then the mainstream of the civil rights movement — no less a leader than Thurgood Marshall thought the idea of a mixed group of black and white people riding buses together through the deep south was dangerous and could lead to a political backlash. The riders were denounced as “agitators” and initially were isolated.

The first freedom ride, in May, 1961, left Washington D.C. but never reached its destination of New Orleans; the bus was surrounded by angry mobs in Birmingham, Alabama, and the drivers refused to continue.

But soon other rides rose up spontaneously, and in the end there were more than 60, with 430 riders. Writes Arsenault:

“Deliberately provoking a crisis of authority, the Riders challenged Federal officials to enforce the law and uphold the constitutional right to travel without being subjected to degrading and humiliating racial restrictions … None of the obstacles placed in their path—not widespread censure, not political and financial pressure, not arrest and imprisonment, not even the threat of death—seemed to weaken their commitment to nonviolent struggle. On the contrary, the hardships and suffering imposed upon them appeared to stiffen their resolve.”

The Occupy movement has already shown similar resolve — and the police batons, tear gas, pepper spray, and rubber bullets have only given the movement more energy and determination.

David S. Meyer, a professor at U.C. Irvine and an expert on the history of political movements, notes that the civil rights movement went in different directions after the freedom rides and the March on Washington. Some wanted to continue direct action; some wanted to continue the fight in the court system and push Congress to adopt civil rights laws; some thought the best tactic was to work to elect African Americans to local, state and federal office.

Actually, all of those things were necessary — and Occupy will need to work on a multitude of levels, too, and with a diversity of tactics.

Single-day events have had an impact, too. Earth Day, 1970, was probably the largest single demonstration of the era — in part because it was so decentralized. A national organization designed events in some cities — but hundreds of other environmentalists took the opportunity to do their own actions, some involving disrupting the operations of polluters. The outcome wasn’t a national platform but the birth of dozens of new organizations, some of which are still around today.

There’s an unavoidable dilemma here for this wonderfully anarchic movement: The larger it gets, the more it develops the ability to demand and win reforms, the more it will need structure and organization. And the more that happens, the further Occupy will move from its original leaderless experiment in true grassroots democracy.

But these are the problems a movement wants to have — dealing with growth and expanding influence is a lot more pleasant than realizing (as a lot of traditional progressive political groups have) that you aren’t getting anywhere.

All of the discussions around the next step for Occupy are taking place in the context of a presidential election that will also likely change the makeup of Congress. That’s an opportunity — and a challenge. As Meyer notes, “social movements often dissipate in election years, when money and energy goes into electoral campaigns.” At the same time, Occupy has already influenced the national debate — and that can continue through the election season, even if (as is likely) neither of the major party candidates is talking seriously about economic justice.

That’s why a formal platform could be so useful — candidates from President Obama to members or Congress can be presented with the proposals, and judged on their response.

Some of the Occupy groups are talking about creating a third political party — a daunting task, but certainly worth discussion.

But the important thing is to let this genie out of the bottle, to move Occupy into the next level of politics, to use a convention, rally, and national event to reassert the power of the people to control our political and economic institutions — and to change or abolish them as we see fit.

OCCUPY AMERICA IS ALREADY UNDERWAY

All across the country, Occupy organizers are developing and implementing creative ways to connect and come together, many of which we drew from for our proposal. We hope all of these people will build on each other’s ideas, work together, and harness their power.

From invading the halls of Congress to “occutripping” road trips to ballot initiatives, here is a list of groups already working on ways to Occupy America:

OCCUPY CONGRESS

Occupy Congress is an effort to bring people from around the country — and, in many cases, from around the world — to Washington DC on Jan. 17. The idea is to “bring the message of Occupy to the doorstep of the capital.” The day’s planned events include a “multi-occupation general assembly,” as well as teach-ins, idea sharing, open mics, and a protest in front of the Capitol building.

A huge network of transportation sharing was formed around Occupy Congress, with a busy Ridebuzz ridesharing online bulletin board, and several Occupy camps organizing buses all around the country, as well as in Montreal and Quebec.

There are still two Occupy tent cities in DC, the Occupy DC encampment at McPherson Square and an occupation called Freedom Plaza, just blocks from the White House. Both will be accepting hundreds of new occupiers for the event, although a poster on the Occupy Congress website warns that “the McPherson Square Park Service will be enforcing a 500 person limit.”

www.occupyyourcongress.info

OCCUPY BUS

The Occupy Bus service was set up for Occupy Congress, but organizers say if the idea works out, it can grow and repeat for other national Occupy calls to action. They have set up buses leaving from 60 cities in 28 U.S. states as well as Canada’s Quebec province. The buses are free to those who can’t afford to pay, and for those who pay, all profits will be donated to Occupy DC camps.

If all goes to plan, buses will be packed with passengers, their gear, and bigger donations for the event, as the “undercarriages of a bus are voluminous.” What gear do they expect each occupier to bring? “One large bag, one small bag, and a tent.”

congress.occupybus.com

DENVER OCCUTRIP

Many occupations have put together car and busloads of people to road trip to other occupations, hoping to learn, teach, network, and connect the movement across geographic barriers. One example is the Denver Occutrip, in which a handful of protesters toured West Coast occupations. The tenacious Occupy Denver recently made headlines when, rather than allow police to easily dismantle their encampment, a couple of occupiers set the camp on fire. It sent delegates to Occupations in Las Vegas, Los Angeles, Long Beach, Oakland, San Francisco, Berkeley, and Sacramento.

Sean Valdez, one of the participants, said the trip was important to “get the full story. What I’d been told by the media was that Occupy Oakland was pretty much dead, but we got there and saw there are still tons of dedicated, organized people working on it. It was important to see it with our own eyes, and gave a lot of hope for Occupy.”

Like lots of road-tripping Occupiers, they made it to Oakland for the Dec. 12 West Coast Port Shutdown action there. In fact, “occutrippers” from all around the country have flocked to Bay Area occupations in general, and especially the uniquely radical Occupy Oakland.

www.occupydenver.org/denver-occutrip-road-trip/

OCCUPY THE CONSTITUTION

An Occupy Wall Street offshoot — Constitution Working Group, Occupy the Constitution — argues that many of the Occupy movements concerns stem from violations of the constitution. They hope to address this with several petitions on issues such as corporate bailouts, war powers, public education, and the Federal Reserve bank. The group hopes to get signatures from 3-5 percent of the United States population before the list of petitions is “formally served to the appropriate elected officials.”

www.givemeliberty.org/occupy

THE 99% DECLARATION

This is a super-patriotic take on the Occupy movement, described on its website as an “effort run solely by the energy of volunteers who care about our great country and want to bring it back to its GLORY.” The group’s detailed plan includes holding nationwide elections on the weekend of March 30 to choose two delegates from “each of the 435 congressional districts plus Washington, D.C. and the U.S. Territories.”

These delegates would write up lists of grievances with the help of their Occupy constituents, then convene on July 4, 2012 in Philadelphia for a National General Assembly. They plan to present a unified list of grievances to Congress, the President, and the Supreme Court. If the grievances are not addressed, they would “reconvene to organize a new grassroots campaign for political candidates who publicly pledge to redress the grievances. These candidates will seek election for all open Congressional seats in the mid-term election of 2014 and in the elections of 2016 and 2018.”

www.the-99-declaration.org/

MOVE TO AMEND/OCCUPY THE COURTS

Move to Amend is a coalition focusing on one of the Occupy movement’s main concerns: corporate personhood. The group hopes to overturn the Citizens United vs. Federal Elections Commission ruling and “amend our Constitution to firmly establish that money is not speech, and that human beings, not corporations, are persons entitled to constitutional rights.”

The group has drafted a petition, signed so far by more than 150,000 people, and established chapters across the country. Its next big step is a national day of action called Occupy the Courts on Jan. 20. On the anniversary of the Citizens United ruling, the group plans to “Occupy the US Supreme Court” and hold solidarity occupations in federal courts around the country.

www.movetoamend.org/

THE OCCUPY CARAVAN

The Occupy Caravan idea originated at Occupy Wall Street, but the group has been coordinating with occupations across the country. If all goes according to plan, a caravan of RVs, cars, and buses will leave Los Angeles in April and take a trip through the South to 16 different Occupations before ending up in Washington DC.

Buddy, one of the organizers, tells us that the group already has “a commitment right now of 10 to 11 RVs, scores of vehicles, and a bio-diesel green machine bus. This caravan will visit cities, encircle city halls, and visit the local Occupy groups to assert their presence, and move on to the next, not stopping for long in each destination.”

This caravan is all about the journey, calling itself a “civil rights vacation with friends and family” and planning to gather “more RVs, more cars, more supporters…and more LOVE” along the way.

occupycaravan.webs.com

OCCUPY WALL STREET WEST

The Occupy movement in San Francisco has been relatively quiet for the past few weeks, but it’s planning to reemerge with a bang on Jan. 20, with an all-day, multi-event rally and march that aims to shut down the Financial District.

The protest is an effort to bring attention to banks’ complicity in the housing crisis plaguing the United States, and how that process manifests itself here in San Francisco.

At least 20 events are planned, centered in the Financial District. The plans range from teach-ins at banks to “occupy the Civic Center playground” for kids to a planned building takeover where hundreds are expected to risk arrest. A list of planned events can be found at www.occupywallstwest.org/wordpress/?page_id=74.

The day is presented by the Occupy SF Housing Coalition, which includes 10 housing rights and homeless advocacy groups. Dozens of other organizations will be involved in demonstrations throughout the day. “We’re asking the banks to start doing the right thing,” said Gene Doherty, a media spokesperson for the Occupy SF Housing Coalition. “No more foreclosures and evictions for profits. On the 20th, we will bring this message to the headquarters of those banks.”